Jump to winners | Jump to methodology

For the 2023 Wealth Professional Top 50 Wealth Management Wholesalers survey, hundreds of wealth management advisors across Canada weighed in on the difference makers that distinguish the best wealth management wholesalers in the industry.

Below are some of the opinions voiced:

All of WP’s winners provide these services and more, proving they deserve their recognition.

“You need to be knowledgeable about your products and the competition. But, more importantly, you have to show advisors ideas and concepts they’re not familiar with in order to truly add value and thus earn the right to ask for their business”

Amélie Laferrière, Sun Life Global Investments

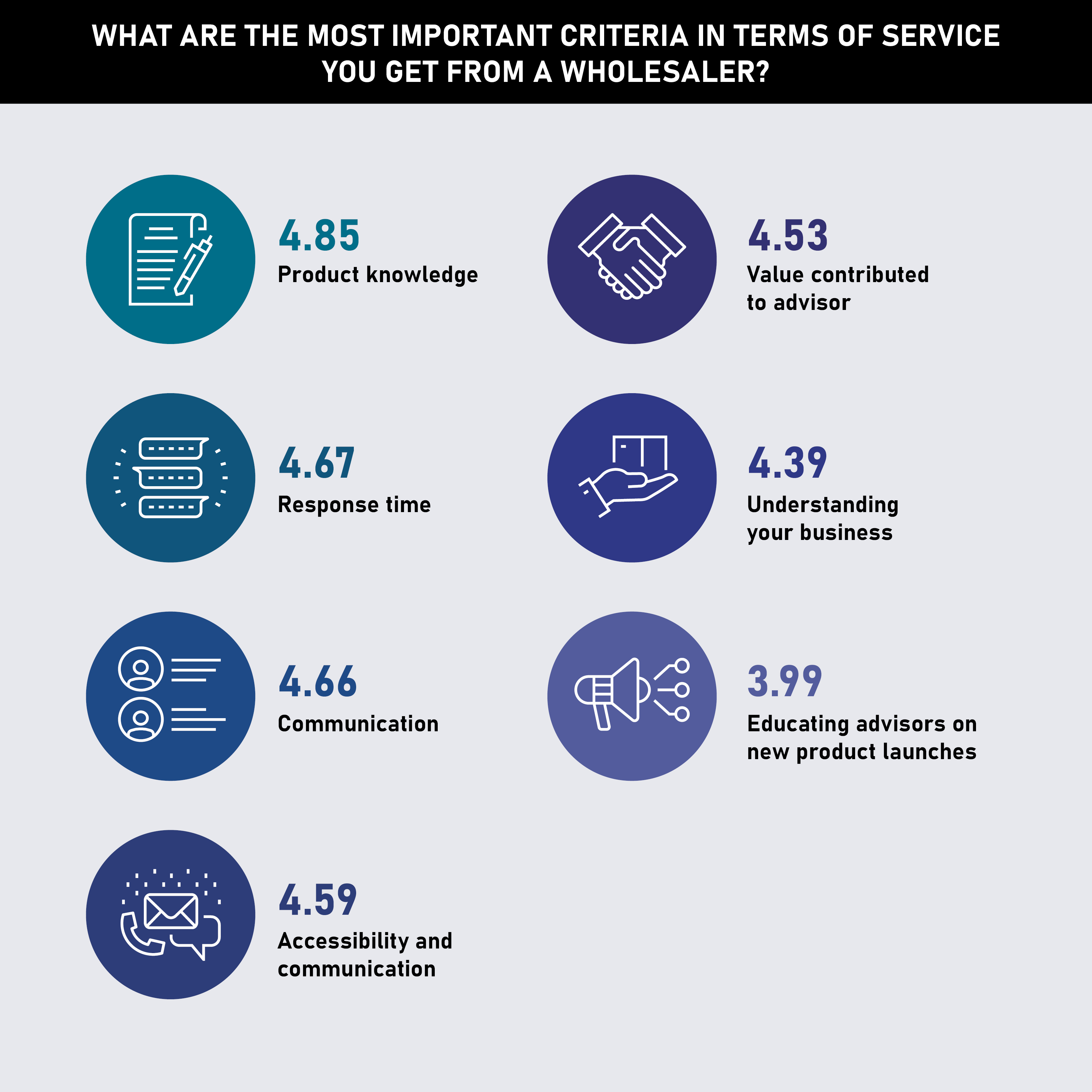

Advisors ranked their most importance criteria, and the results are shown below.

Leading salesperson for Sun Life Global Investments, Top 50 Wealth Management Wholesaler Amélie Laferrière is not surprised by WP’s data.

“To me, being knowledgeable comes first and foremost,” says Laferrière. “You need to be knowledgeable about your products and the competition. But, more importantly, you have to show advisors ideas and concepts they’re not familiar with in order to truly add value and thus earn the right to ask for their business.”

Discussing her own approach to being one of the best wealth management wholesalers, the self-described “nerd” explains, “I’m known to be more technical than the average wholesaler. My institutional background helps me focus on process-driven investments and how it can be a complement to existing holdings.”

This layer of understanding has a direct benefit. “Understanding the classifications of our various products on the dealer shelf and the potential impact to a client allows me to better advise my advisor to prevent future regulatory problems. I even sometimes warn them on what to look out for to avoid the regular NIGOs we see. Our product mix is more complicated than most and I’m instrumental in building the infrastructure of our CRM to accurately represent dually licenced advisors.”

This ethos is echoed by Picton Mahoney Asset Management’s Scott Hickerson. He takes pride in being informed enough to deliver the best fit.

“It’s not enough to have one of your funds/ETFs fit from a portfolio perspective. It must also fit from a KYC (end investor) perspective and dealer classification perspective. I can think of numerous instances when I see a first buy from an advisor that was in the wrong version of the strategy we discussed.”

He adds, “You must know your product, your advisor’s business and how their dealer classifies things. I feel our industry makes things too complicated and has a lot of jargon. Being able to distill complex ideas into more easily understood ones is something we strive for.”

“In personal business terms, I have only ever been rewarded for persistence in this role”

David Roy, Invico Capital Corporation

Another of the Top 50 best wealth management wholesalers, Alyssa Moody, of Dynamic Funds, makes a concerted effort to be a “key partner” to her clients. Her goals are:

Providing the optimum result is a theme that resonates with Tesha Gray of Mackenzie Investments. Comprehending her industry and relaying that has allowed her to reap success.

“I see the investment world through the eyes of my advisors. Always. Most wholesalers and asset managers put their agenda first, often lacking real insight into the current challenges faced today by financial advisors. Advisors appreciate my ability to hear them out and customize a service model to meet their needs. This has set me apart from my competition for over 12 years on the road.”

Sara Dowlatshahi of Dynamic Funds attributes her success to being available.

"My advisors know they can reach me morning, noon and night regardless of the day of the week. They are on call for their clients and, of course, have come to expect the same from me,” she explains.

This is mirrored by her colleague Jessie Dawe, who ensures inbound calls and emails are answered within an hour. She says, “These seem like simple tasks, but it is extremely effective.”

Another who operates a strict regime is Gray. “I have a goal of returning all client inquiries in a 24-hour period. If we don’t have the answer, we reach out so our clients know we’re working hard at handling any requests. I’ve created a rotation to keep advisors updated on our top holdings,” she explains.

“Wholesalers must be impactful. We have limited face time with advisors. These interactions must provide value, not only for advisors but their clients as well”

Jad Hilal, Sun Life Global Investments

However, it’s not simply about being available. Format and delivery are also vital in today’s digital age.

“We’ve utilized our technology to customize our fund updates. I know time is limited for all reps, [so] I try to compose a short, easy-to-digest update with key outlooks, current portfolio positioning and a few sound bites from the management team,” Gray explains. “By creating a quick read with information they can use with clients, advisors began looking forward to my updates and the feedback was overwhelmingly positive.”

Taking a similar stance is Dowlatshahi, who acknowledges the need to be communicating valuable information only.

“The markets and macro data changes with unprecedented velocity and as such, I must be ready with strong views and direct advice via the right product, strategy and analytics.”

She adds, “Anticipating what my advisors can benefit from ahead of time has made me their 'first call' and the wholesaler they look to for direction first.”

This is mirrored by Dawe, who highlights how the communication process is multipronged.

“Prior to every meeting, my team member will phone the advisor to review the agenda and get an idea of exactly what they want to cover. After the meeting, I then send a follow up, confirming we covered everything and within one week they will get another call from my team to answer any questions.”

Winner David Roy doubles down on perseverance.

“In personal business terms, I have only ever been rewarded for persistence in this role,” explains Roy, vice president of sales east at Invico Capital Corporation. He has increased his advisor network by more than 233% over the past 18–24 months.

“While this has translated into business for my firm, it has also been viewed positively by my advisors and clients. When done right, this role identifies a solution that solves a problem in an advisor’s business.”

Echoing Roy’s assertion, survey participant Thomas Tsiaras, a portfolio manager at Aligned Capital Partners, says an ideal wealth management wholesaler “reacts very quickly to responses and introduces concepts/products that are new and might not have been heard of personally yet.”

Meanwhile, Sun Life Global Investments’ wealth sales director Jad Hilal says, “Wholesalers must be impactful. We have limited face time with advisors. These interactions must provide value not only for advisors but their clients as well.”

And he continues, “Business is earned. It is no longer about throwing things on the wall to see what sticks. Much like active asset managers, now more than ever, it is a bottom-up approach, rolling up our sleeves to help existing and prospective advisors earn their client’s business."

To uncover the best wholesalers in the Canadian wealth management industry, the Wealth Professional team undertook a rigorous marketing and survey process, leveraging WP’s connections to thousands of advisors across the country. Advisors were asked to nominate their wholesalers for consideration and rate them on their product knowledge, communication, response time, accessibility, understanding of the advisor’s business, ability to educate the advisor and the value they contribute. The WP team then invited the wholesalers to submit nominations, detailing their achievements in the past 12 months, including specific examples of their professional accomplishments and contributions to the industry as a whole. The WP team reviewed all nominations, examining how each individual had made a meaningful contribution to the industry, to whittle down the list to the final Top 50 Wholesalers.