Firm: Mandeville Private Client

Location: Ottawa, ON

Employees: 10

AUM: $350 million

Target clients: Advice-seeking individuals with assets of $250,000 or more

This September will mark 34 years in the wealth management industry for Michael Prittie, portfolio manager, senior financial advisor and branch manager of Capital Wealth Partners at Mandeville Private Client Inc. Throughout those years, Prittie has learned a lot, and he imparts those lessons on his team as his branch continues to grow.

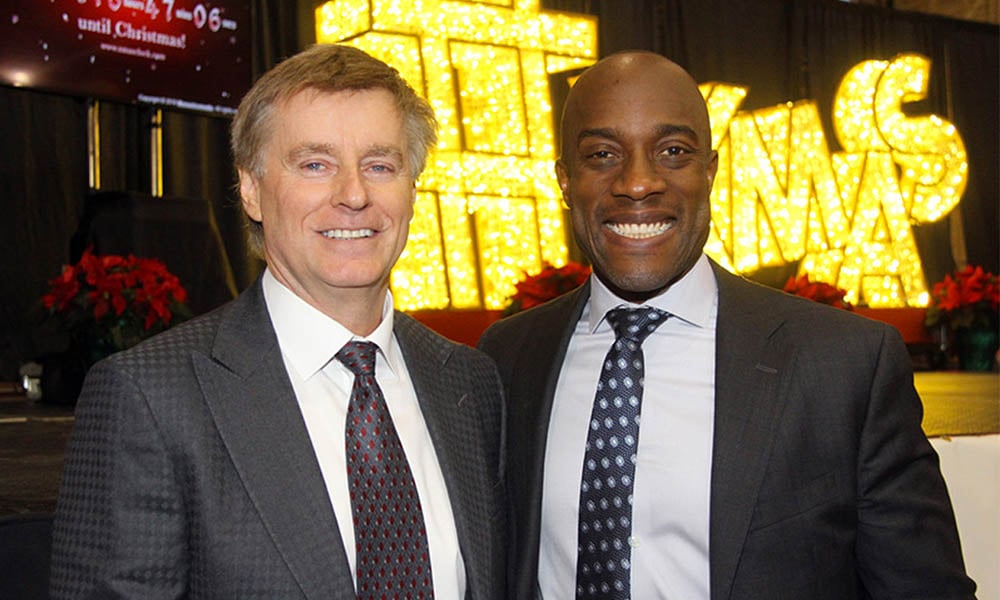

Prittie started out at a large financial planning/investment firm. It was there that he hired one of his most respected team members. “I hired and mentored Duane Francis, who followed me once I moved to an IIROC platform in 2001,” Prittie says. “Then others followed, and we grew from there.”

Prittie moved his practice to Berkshire Securities, which was founded by Portland Holdings chairman and CEO Michael Lee-Chin. In 2008, it became part of Manulife Securities. In 2013, when Lee-Chin formed Mandeville, Prittie was the first to move back. “Mandeville provided access to private equity investing and a managed account platform,” he says. “I think I was the first advisor to ‘repatriate’ to the new firm.”

Since then, Prittie has seen his branch grow steadily. The team now features 10 members, including five advisors, all of whom have numerous designations and plenty of experience. Prittie’s son, Adam, has also joined the team to follow in his father’s footsteps.

“I’ve had steady growth since the beginning, but my assets under administration really went on an upward trajectory after I joined Mandeville,” Prittie says. “The ability to manage portfolios and run discretionary/managed accounts with access to world-class alternative private investments was something my clients really embraced. It led to increased referrals and multi-generational business.”

The private offerings are one differentiator for Capital Wealth Planners, but Prittie feels it really comes down to customer service. “We are regularly complimented on our client service and attention to detail, and I think that is what has made us successful,” he says. “We pride ourselves on doing what is right, not what is easy, and we really try to put ourselves in our clients’ situations.”

With that success comes trust from clients who are confident the team will do what is best for them. “We spend a lot of time on research and controlling emotions,” Prittie says. “I follow the mantra of being greedy when others are fearful and vice versa. Last summer, for example, we started to move away from equities and built up income in our portfolios. Now, with the pullback, we are in a good position to take advantage of some of companies that are well priced. Our clients have been through other downturns – in my case, dating back to 1987 – and they are understanding and accepting. They know to stay the course, not sell and take advantage of the opportunity.”

When it comes to his team’s approach, Prittie aims to mirror two successful leaders: Warren Buffett, by owning great businesses with a track record of growing revenue and earnings, and Michael Lee-Chin’s teachings for creating and preserving wealth. In doing so, his portfolio construction meets the unique needs of his clients.

“For each household, we develop personalized investment policy statements and written financial plans that address their needs – factors like time horizon, risk tolerance, taxation and liquidity needs,” he explains. “We pay careful attention to that when we are building the portfolios and include a combination of public and private securities. We seek to take advantage of the illiquidity discount within privates in order to increase yields and long-term growth. We will rebalance prudently and systematically to take advantage of current market conditions.”

The team also puts a heavy focus on tax planning, looking for tax reduction strategies so clients keep more of their money. To help with this, Capital Wealth Partners prepares a wide variety of tax returns each year, from personal to corporate to estate returns. This in-house service has been very popular, and about 300 families use it.

While the team’s advisors do operate on their own, they rely on collaboration with the rest of the team. Prittie hosts weekly training sessions for all staff, and the advisors meet monthly to discuss strategy, marketing ideas and anything else that might benefit all of their clients. In addition, they host evening seminars and special events for clients throughout the year, and Prittie writes on financial topics for an Ottawa-based magazine.

This spirit of collaboration definitely helps when it comes to tackling challenges. Last year, the key challenge was finding great investments at reasonable prices, Prittie says. That has changed in light of the COVID-19 pandemic, so now the team is focused on keeping emotions in check and finding long-term opportunities for clients in the midst of the crisis.

Moving forward, Prittie’s goal is for the team to continue to grow its professional presence in the Ottawa community. “We are very involved in the community in a number of initiatives,” he says. “We are seen as leaders and educators in the industry and people who can be trusted with capital.”