Succession planning experts unpack why increasingly thorny challenge creates systemic risks for wealth industry

With a significant proportion of individuals set to grey out of the business within the next decade, two experts say more attention must be paid to the increasingly urgent issue of succession planning.

“We have an increasingly aging advisor population,” says George Hartman, the founder of Ultimate Practice, a consulting firm that offers practice management and succession planning coaching to advisors.

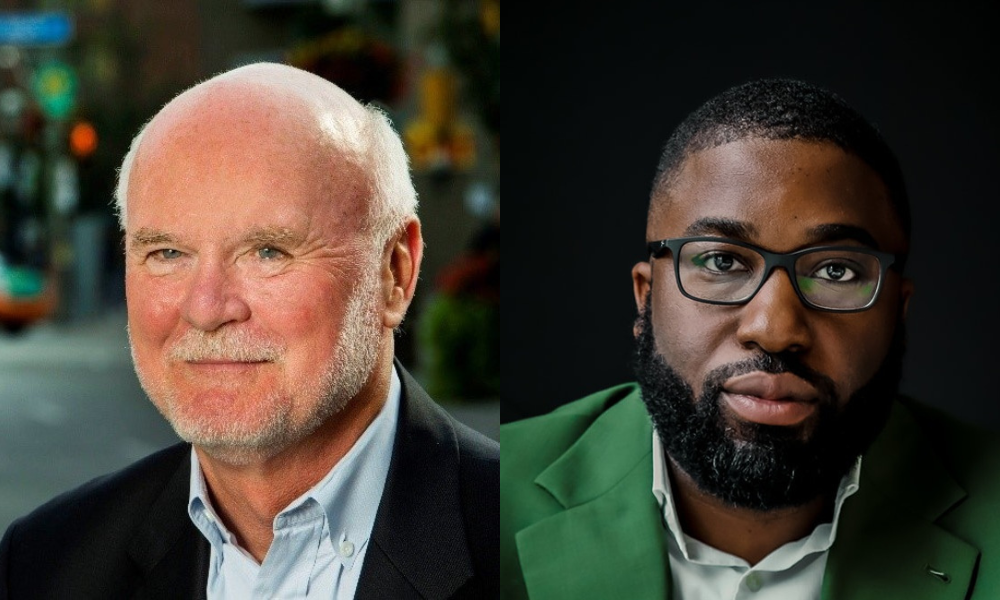

“There are forecasts that somewhere in the neighbourhood of 40% of advisors will retire within the next five to 10 years,” says Hartman (pictured above, left). “There are not enough new entrants coming into the business to replace those who will be exiting.”

Succession planning: so different yet exactly the same

Hartman has been in the financial services industry for 50 years; he’s spent the past 30 as a coach and has increasingly focused on succession planning over the past decade. He recalls how in his early years in the industry, he was able to build three modest books of business and transition them over to other advisors relatively simply.

“You didn’t sell your book of business. If you were leaving and moving on, you could walk down the hall and find another advisor whom you trusted and ask them to take care of your clients. If they really liked what you did, they might take you out for dinner or buy you a good bottle of scotch,” he says. “Now, advisory practices are worth hundreds of thousands, and millions of dollars in many cases.”

The creeping influences of compliance, regulation, and technology, according to Hartman, have disrupted the traditional value propositions of advisors. Where industry professionals used to be able to build a practice on being a good investment manager, broker, or stock picker, clients are increasingly looking for advisors to fulfill their needs as a coach, confidant, and intermediator.

George Boahene, director, National Business Advisory & Succession Planning at Manulife Securities, agrees that the advisory business has changed, and those changes have made the work of succession planning more complicated.

“To me, laws that govern our industry have become much more rigorous and time-consuming. Managing compliance is much more of a headache now than it used to be,” Boahene says. “You’ve got technology in terms of different CRM systems and everything else. You have robo advisors and people setting up corporations to maximize the tax efficiency of their succession process.

“The process of succession planning is unchanged. But the environment and all the elements that impact that consideration have shifted over time, in my opinion.”

A matter of trust

The dangers of poor or mismanaged succession planning are plainly obvious for the individual veteran advisor: client accounts orphaned, assets lost, retention risks, and decades’ worth of collected goodwill wasted, just to name some.

But looking from a bigger-picture perspective, both Hartman and Boahene see a larger systemic problem brewing.

“The dealer-brokerage system is confronting a real issue internally. Many of them are looking at their most experienced and highest-value advisors retiring in the next five to 10 years,” Hartman says. “They haven’t created enough internal succession opportunities for them to be assured that the books of business will stay within their firm.

“What we find is their advisors either go shopping to find the highest bidder for their books of business, or the business just gets broken up and scattered among other advisors in the firm. That’s often not good for the client, and they’ll use a change in advisors as a reason to take their assets elsewhere.”

“If we don’t manage the ongoing succession of advisors, there could be the risk of loss of confidence in the industry – from clients, customers, and everybody else,” Boahene says. “I think that’s why in the States, the SEC has proposed to mandate enhanced safeguarding rules related to business continuity and transition plans for registered investment advisors. No such requirements in Canada, but advisors are definitely encouraged to do succession planning in some way, shape or form.”

“Back then, it was a struggle to get people to even talk about succession planning,” Hartman says. “Now, there's a much greater willingness to have that conversation, although it's still not anywhere near where it needs to be.”