Report says that the investment banking industry needs to keep up with technology to remain competitive

The personal relationships that are a traditional core of investment banking may be holding the industry back from innovation.

A new report from Toronto-based information technology research and advisory firm Info-Tech Research Group says that the need for transformation in the financial industry has never been higher as firms prepare for new products and services.

But it warns that the traditional services offered by investment banks are changing fast due to new technology, competition, and market forces.

The cost of doing business, customer demands, and competitive products and services are all accelerating the pace of change and firms must ensure that technology leaders stay closely aligned with business partners and stakeholders to ensure they play an active role in developing new products and services.

"Traditionally, the investment banking industry was built upon personal relationships and networks," says David Tomljenovic, Head of Financial Services Industry Research at Info-Tech Research Group. "However, a relationship-driven approach to many of the core functions in an investment bank has had the effect of blocking the adoption of new ways of doing business. Competitive forces, many of which are accelerated and enabled by technology, are reshaping many aspects of the investment banking industry."

Trends

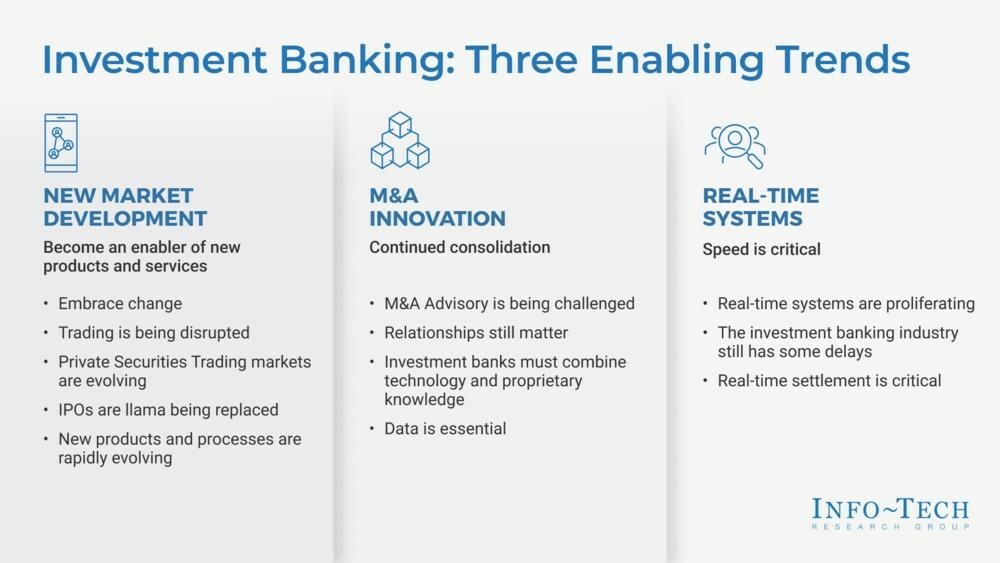

In its report The Future of Investment Banking, the firm highlights three key trends that it says will impact the industry in the years ahead:

- New Market Development Through Innovation – Investment banks must be actively developing new markets. Increasingly, new markets are being identified, built, and operated with advanced technologies. For investment banks to succeed in new markets, they must work cooperatively across many stakeholders and business units. In order to overcome the threats represented by changes in the market and to thrive by developing new opportunities, IT should be fully engaged and aligned with the business.

- Merger & Acquisition Innovation – According to Info-Tech's research, technology is reshaping the way M&A is executed by investment banks. This means that digital adoption has become imperative to remain competitive in new business and economic environments. As the situation progresses, M&A innovation is going to come in many forms with broad-based implications for the technology teams that must support the innovation. CIOs and their teams will need to be active participants throughout the innovation process.

- Real-Time Systems (RTS) – Real-time systems will increasingly become a necessity throughout financial services as internal and external customer expectations drive their continued need. The transition to RTS will likely present many new business and technology challenges, with potential impact across all parts of an investment bank. Working in cross-functional teams with an agile approach will enhance stakeholder satisfaction with the transformation and help educate stakeholders to enable future RTS transformations.

The full report is available on the firm’s website.