Learn how health insurance for high-net-worth individuals helps in wealth preservation. This article can guide your clients in finding the right policies

- What health insurance options are available for high-net-worth individuals in Canada?

- Private health insurance

- Disability insurance

- Critical illness insurance

- Long-term care insurance

- Why do high-net-worth individuals need health insurance?

- How can high-net-worth individuals use health insurance to protect their wealth?

For those who have built substantial wealth and assets, having the right insurance is crucial in protecting against potentially devastating losses. Health insurance is among the types of coverage that can help wealthy Canadians preserve their net worth.

In this article, Wealth Professional delves deeper into health insurance for high-net-worth individuals. We’ll discuss the different types of policies available and how your high-net-worth clients can use health coverage to their benefit.

What health insurance options are available for high-net-worth individuals in Canada?

Wealthy individuals can use health insurance to protect the earnings and assets they’ve worked hard for if they fall ill. They can also use this type of coverage to access the best medical care possible.

There are several types of health insurance products on the market, each with its unique set of features that the wealthiest Canadians can take advantage of. These include:

- private health insurance, also called personal health insurance

- disability insurance

- critical illness insurance

- long-term care insurance

Let’s go through them one by one.

Private health insurance

Canada has one of the most comprehensive healthcare systems in the world. But while the country’s universal healthcare system gives free access to emergency care and regular doctor visits to all citizens and permanent residents, it doesn’t cover everything.

Canadians need to pay for several treatments and services out of pocket. These include:

- ambulance and EMT services

- private hospital room stays

- medical equipment, such as crutches, leg braces, and wheelchairs

- outpatient prescription medications

- massage therapy

- physiotherapy

- psychological services

- prescription eyeglasses

- dental care

This is why taking out private health insurance is a good option for many high-net-worth individuals.

Private health plans pay for certain medical services that standard health insurance policies don’t cover. These include the items listed above. According to the Financial Consumer Agency of Canada (FCAC), taking out private health insurance has three main benefits:

- paying for treatments and services not covered by the national health insurance program

- supplementing income if a serious injury or illness prevents one from working

- covering medical costs from injury or sickness while travelling overseas

If you want to learn more about how the healthcare system and health insurance work in Canada, you can check out this guide from our sister publication Insurance Business.

How much does health insurance for high-net-worth individuals cost?

Premiums for private health coverage vary depending on a range of factors, including the person’s age and overall health status, and the policy’s coverage levels. An average Canadian in their mid-30s and in good health may pay around $725 to $750 each year for private health coverage – a pretty small amount for the country’s affluent.

Wealthy individuals, however, often have unique healthcare needs that may drive up insurance costs. They may want access to an extensive list of healthcare specialists. They may value privacy and personalized coverage. High-net-worth individuals who often travel the world may also prefer health insurance with global coverage.

The bottom line is that rich Canadians want features and benefits that standard health plans don’t provide – and they aren’t worried about incurring additional costs.

Disability insurance

Disability coverage is designed to protect what is perhaps a person’s most significant asset – their ability to earn a living. Policies typically pay out a portion of one’s income if they are unable to work because of an illness or injury.

Most long-term disability policies, however, offer a low maximum, usually $10,000 a month, which is insufficient to meet the needs of high-income earners. Depending on how the premiums are paid, this amount can be fully taxable, further reducing how much policyholders receive.

For high-net-worth individuals, taking out high-limit disability insurance is a better option. Such policies can provide up to $150,000 monthly or $2 million in annual coverage tax-free.

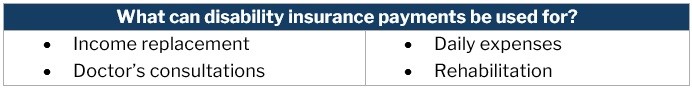

How does disability insurance work?

Disability insurance provides financial protection if the policyholder suffers an unexpected illness or injury that leaves them unable to work or earn a living. Also referred to as income protection insurance, these policies pay between 60 percent and 85 percent of a person’s regular income. This is until they recover and resume working or until the end of the coverage period, whichever comes first.

Wealthy individuals can opt for the maximum coverage amount that their financial situation allows and purchase additional top-ups to fit their insurance needs. One advantage of having disability insurance is that it’s portable. This means the insured can take it even if they change employers. If policyholders pay premiums using their after-tax income, the benefits they will receive are also non-taxable.

What are the different types of disability insurance?

Generally, there are two types of disability coverage:

Short-term disability insurance

This provides income coverage for short-term or temporary health issues, usually lasting between six and 26 weeks – although it can be extended up to 52 weeks (one year). Benefit payments can start as soon as the insured has used up their sick leave or one to 14 days after a claim is submitted.

Long-term disability insurance

This covers more persistent health issues, with coverage starting right after the short-term disability period. Depending on the insurer, coverage can last between two and five years. However, the coverage period can extend until the age of 65 – the standard retirement age – if the policyholder is still unable to work.

How do insurers define disability?

Insurers have three main definitions of disability, according to Canada.ca. These are:

-

Own occupation: policyholders are eligible for benefits if a disability prevents them from performing the duties of their pre-injury occupation

-

Regular occupation: works like own-occupation plans, but with one main difference – if the policyholder chooses to work in a different profession, their benefits will either be reduced or fully withdrawn

-

Any occupation: the most stringent type of disability insurance where policyholders are ineligible to receive benefits if they can work in any other profession; this type of plan also has the lowest premiums

A recent poll also revealed that more Canadian workers view mental health issues, such as depression and anxiety, as a disability.

Critical illness insurance

Most critical illness insurance policies pay out a lump sum that the policyholder can use to replace lost wages or pay for treatment-related costs.

Catastrophic illnesses often require expensive medical care, and these costs can easily eat away at one’s finances. Having critical illness coverage can help protect a person’s wealth against exorbitant medical bills.

Another strategy industry experts recommend is opting for a return-of-premium feature. This allows policyholders to reimburse all premiums paid if no claim has been made against the insurance plan.

How does critical illness insurance work?

Critical illness insurance pays out a “living benefit” as opposed to a death benefit in life insurance policies. It is called a living benefit because it is paid while the policyholder is alive, regardless of whether they have recovered from the illness or not.

Just like life insurance, however, critical illness policies come in two types:

-

Term critical illness insurance: covers illnesses suffered by the policyholder for a fixed period

-

Permanent critical illness insurance: covers the policyholder until death, with the option to pay premiums upfront, typically over a 10 or 20-year period

What does critical illness insurance cover?

In 2018, the Canadian Life and Health Insurance Association (CLHIA) updated its Critical Illness Benchmark Definitions to standardize the language used for common conditions across the industry.

The association listed and defined 26 “common illness, conditions, and health events” in its publication. The protection that critical illness insurance offers, however, isn’t limited to these afflictions. Some insurers provide coverage for illnesses not on CLHIA’s list and even have their own definitions.

The 26 conditions that CLHIA defined in its latest benchmark are:

Cancers and tumours:

- benign brain tumour

- cancer (life-threatening)

Cardiovascular:

- aortic surgery

- coronary artery bypass surgery

- heart attack

- heart valve replacement or repair

- stroke (cerebrovascular accident)

Neurological:

- bacterial meningitis

- dementia, including Alzheimer’s disease

- motor neuron disease

- multiple sclerosis

- Parkinson’s disease and specified atypical Parkinsonian disorders

Vital organs:

- kidney failure

- major organ failure on waiting list

- major organ transplant

Accident and functional loss:

- acquired brain injury

- blindness

- coma

- deafness

- loss of independent existence

- loss of limbs

- loss of speech

- paralysis

- severe burns

Other conditions:

- aplastic anemia

- occupational HIV infection

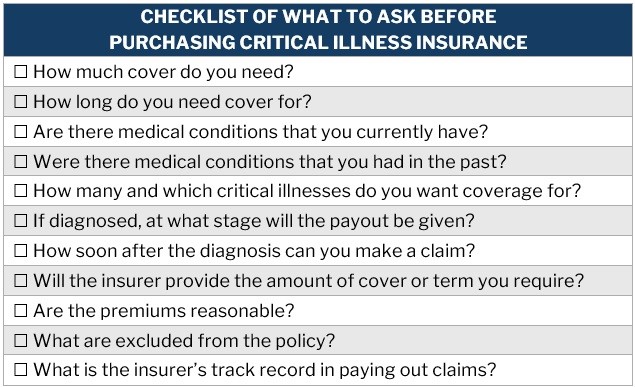

What should individuals consider when taking out critical illness insurance?

Before taking out critical illness cover, there are several questions that high-net-worth individuals need to ask to ensure that a policy fits their needs. The table below lists some of these questions:

Long-term care insurance

A good portion of high-net-worth individuals in Canada has reached or is approaching senior age. This makes long-term care (LTC) coverage a sound insurance option, especially with the high cost of long-term care services, which can easily exhaust a person’s retirement savings.

This is also the reason why many industry experts recommend taking out long-term care insurance for those who can afford to. Apart from helping seniors protect their retirement fund, this type of coverage gives them the option to get the best care possible.

Similar to critical illness insurance, some long-term care policies offer a return-of-premium option for policyholders who do not make a claim.

How does long-term care insurance work?

Long-term care insurance pays out the cost of medical and nonmedical services provided for senior-aged individuals who have lost the ability to care for themselves. Long-term care benefits are non-taxable in Canada.

Generally, LTC policies follow two types of models:

-

Income-style benefit plan: pays out a pre-set benefit amount every month for a set period, although most insurers cap the duration at two years

-

Reimbursement-style plan: provides reimbursements for the long-term care services provided, with most insurers imposing limits on the amount the policyholder can receive

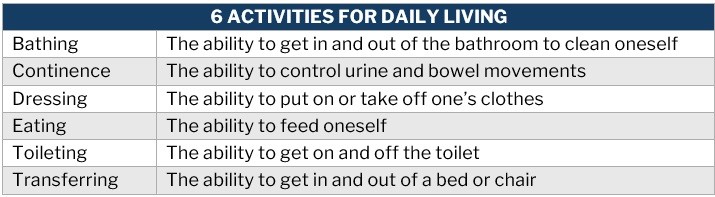

Who is eligible for long-term care insurance?

To qualify for benefits, the policyholder needs to get certification from a reputable healthcare provider. The certification must state that they can no longer perform at least two of the following “activities for daily living,” or ADLs, without direct assistance.

Most policies require beneficiaries to pay for care services out of pocket for a certain timeframe. This usually lasts between 30 and 90 days, after which the insurance provider begins the payments. Long-term care insurance plans pay out up to a daily limit for care services until the lifetime maximum is reached.

Why do high-net-worth individuals need health insurance?

It is often assumed that the need for health coverage decreases as individuals reach a certain net worth. This is because they also hit a stage where they can afford the best medical care possible.

But in reality, the more a person’s wealth grows, the more health insurance can prove valuable in helping them protect their assets. Here are some of the reasons why health insurance may be crucial for high-net-worth individuals:

Health insurance protects high-net-worth individuals' most valuable asset

For many affluent people, their most important asset is their ability to earn income. This is often where their financial security lies. Because of this, protecting this asset should be the cornerstone of their financial plan.

This is where critical illness and disability insurance come into play. These types of coverage serve as a form of financial cushion if they are unable to work, either temporarily or permanently.

Health risks increase as people grow older

Getting older is a fact of life and as people move closer to senior age, the risk of developing chronic and other age-related health issues also grows. During this stage, health insurance for high-net-worth individuals can play a key role in wealth management and preservation.

Family has a history of expensive medical conditions

Surviving a critical medical condition presents its share of challenges, including the excessively high medical expenses associated with treatment and recovery. Because of this, taking out health insurance is beneficial, especially for those who have a family history of expensive medical conditions.

How can high-net-worth individuals use health insurance to protect their wealth?

Almost everything works differently for high-net-worth individuals – and this includes health insurance. Wealthy Canadians have unique healthcare needs, lifestyle, and financial situation that require a different approach to health coverage. To help protect their wealth and assets, they will need insurance options tailored to their specific circumstances.

An experienced financial advisor can help high-net-worth families protect their wealth with the right health planning strategies.

If you’re among the country’s ultra-rich and are searching for an industry expert to guide you, our Best in Wealth Special Reports page is the place to go. The companies and professionals featured in our special reports are recognized for their exceptional work within the industry. By partnering with them, you can be sure the wealth you’ve painstakingly built is well-managed and protected.

Do you think health insurance for high-net-worth individuals is worth it? Let us know in the comments