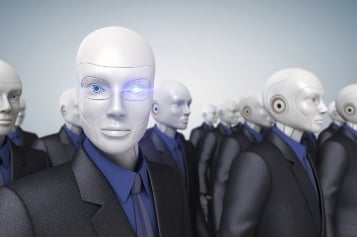

If a client can get all the services they need through a web platform for less money, why would they pay extra for a human advisor?

As digital offerings in the marketplace grow in sophistication, usability and popularity, it’s natural for advisors to feel threatened. If a client can get all the services they need for cheaper through a web platform, why would they pay extra for a human advisor? Along with tightening regulation, the rise of fintech is forcing advisors to adapt their practices. But rather than being threatened by changes in the industry, advisors should be seeing the tumult as an opportunity to grow.

Cary List, President & CEO of the Financial Planning Standards Council (FPSC), believes that, in order to thrive in the new reality of the industry, advisors need to focus on building relationships, becoming truly holistic in their approach or specializing in a complex or particularly technical area.

“Advisors should focus on the human side of the equation and work out ways to connect with clients and help them figure out what their true needs are - that is something that is desperately needed by consumers and something that technology cannot supplant,” List says. “People still want to be able to sit down with a human who they trust and who understands them as a person, so there is a huge opportunity there.”

Becoming truly holistic should be seen as a natural extension of an advisor’s attempts to build long-term relationships and maximize the benefits of the human-factor. Although robo-advisors’ rise has been rapid, fintech is still some way away from being able consider a client in their entirety and analyze how they may be impacted by the emotions that come with investing and financial planning.

“It’s not just about creating returns within a portfolio. Advisors should be helping clients achieve the financial health and wellbeing that enables them to do what they want,” List says. “Looking at a client as a whole, and taking a holistic view, is something that technology will not be able to compete with.”

Taking a deeper dive in terms of expertise and committing to a specialization is also an option for advisors who want to standout as automation and fintech grow in popularity. Technology is limited in its ability to handle complex investments and specific estate strategies, and that gives advisors another opportunity to boost their value proposition.

List believes that, ultimately, advisors who can demonstrate they are worthy of trust will be well-positioned to benefit from the changes occurring in the industry. “Canadians may be able to get an investment recommendation or an asset allocation plan from a digital platform, but they need more than that.” List says. “Regulations are pushing the industry to put clients’ interests first and advisors who develop the appropriate proficiencies to deliver on those needs are going to be recognized for the value they bring. Advisors who don’t have those proficiencies won’t be able to compete.”

Related stories: