Are your clients looking for the best partners in wealth management? This guide ranks the top investment firms in Canada by customer satisfaction scores

There are many investment firms offering everything from traditional mutual funds to complex institutional strategies. Some specialize in alternative assets like infrastructure or private equity, while others focus on comprehensive wealth planning with estate and tax support. Each investment firm has its own approach, strengths, as well as ideal client types.

As a financial advisor, knowing how these firms differ can help you match your clients with the right solutions. In this article, Wealth Professional Canada will explore the top investment firms in Canada. We’ll primarily talk about why they made it to the list. Want to find the most suitable investment firm that’ll support your clients’ financial goals? Read on for more.

What are the top five investment firms in Canada?

Based on 1,000-point scale, here are the top five investment firms in the country:

- National Bank Financial

- Edward Jones

- iA Private Wealth

- CI Financial (Assante Wealth)

- Desjardins

Some of the services that these financial giants can provide include:

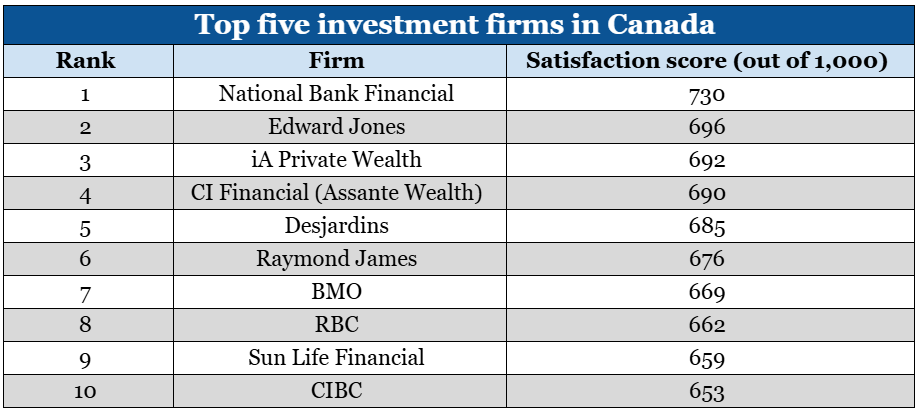

Top 10 investment companies in Canada

As a bonus, instead of just the five, we’ve listed the top 10 investment firms in Canada below. Check out this comparative table of the 10 investment firms that ranked the highest:

For the list, we used the 1,000-point ranking system from a study conducted by J.D. Power. Let’s take a closer look at each:

1. National Bank Financial

National Bank Financial earned the top satisfaction rating among investors who hire financial advisors with 730 out of 1,000 points. Its full-service brokerage arm includes over 850 financial advisors managing more than $170 billion in assets.

It operates across many Canadian cities, including:

- Calgary

- Montreal

- Toronto

- Vancouver

2. Edward Jones

At second place is Edward Jones with a score of 696. This top financial firm has roots in the United States, having been founded in St. Louis, Missouri.

Edward Jones operates more than 16,000 branch offices and employs over 20,000 financial advisors worldwide, including more than 870 in Canada.

The firm manages over USD2.2 trillion in assets for more than 8 million investors. In Canada, Edward Jones serves around 190,000 households and manages $58 billion in assets. Edward Jones also ranks among Fortune’s top companies to work for and remains focused on consistent, high-quality financial advice.

3. iA Private Wealth

At third place we have iA Private Wealth. It’s a part of iA Financial Group, one of Canada’s largest insurance and wealth firms. Founded in 1892, iA now has more than $249 billion in assets under management (AUM) and serves over four million clients.

In case you're interested: According to their website, iA Financial Group’s company symbol, the elephant, reflects its core values:

- wisdom gained through experience

- attentiveness

- a sense of responsibility

- strength

- stability

4. CI Financial (Assante Wealth)

CI Assante Wealth Management is part of CI Financial, one of Canada’s largest independent wealth firms. It manages over $532 billion in assets and supports more than 900 advisors across Canada.

This top investment firm has entered into a definitive agreement with Mubadala Capital to take it private. The deal was approved by the Ontario Superior Court of Justice. The transaction is expected to close pending regulatory approval.

5. Desjardins

Founded in 1900, Desjardins serves 7.8 million members and clients. It employs over 55,000 people across the country and is supported by 2,313 elected directors, operating primarily in Quebec and Ontario.

Desjardins has been recognized as a top employer multiple times. In 2024, Forbes named it one of Canada’s Best Employers in the financial services sector. Mediacorp Canada also included Desjardins in its rankings of:

- Top 100 Employers

- Top Employers for Young People

- Greenest Employers

Women in Governance awarded the firm Platinum-level Parity Certification for its leadership in advancing gender equity at all levels of the organization.

6. Raymond James

At no. 6 is Raymond James, a high-ranking investment company that has been publicly listed since 1983. It manages approximately $1.54 trillion in client assets. The firm has over 8,800 financial advisors and maintains equity research coverage on more than 1,200 companies.

With shareholders’ equity of $12.1 billion, Raymond James holds more than twice the required regulatory capital. It has also reported 149 consecutive quarters of profitability.

7. BMO

The Bank of Montréal (BMO) is one of the five largest banks in Canada. It has $1.44 trillion AUM and has served clients for over 200 years since 1817. BMO holds the distinction of being the country’s first bank.

At 196 years, BMO Financial Group has the longest-running dividend payout record of any company in the country.

BMO operates through three core groups:

- BMO Personal and Commercial Banking

- BMO Wealth Management

- BMO Capital Markets

8. RBC

Next is the largest bank in the country at no. 8: The Royal Bank of Canada. It has a market capitalization of about $2.2 trillion. This banking giant was founded in 1864 and has grown to have over 1,200 branches across Canada and other countries.

Besides banking and insurance, the RBC helps people invest their money in:

9. Sun Life Financial

Sun Life is a global financial services company with $1.5 trillion in AUM. It employs more than 66,000 people and supports over 95,000 financial advisors worldwide.

The company provides insurance and wealth solutions in Canada as well as global markets including:

- United States

- United Kingdom

- Australia

- Japan

- Singapore

- Indonesia

- Philippines

- China

Interesting fact: This top investment firm has operated through periods of peace and crisis—most notably safeguarding British securities during World War II.

10. CIBC

Lastly, we have the Canadian Imperial Bank of Commerce’s (CIBC). It manages $255 billion in assets and supports more than two million investors and institutions around the world. CIBC’s team includes over 160 investment professionals, each averaging more than 17 years of industry experience.

CIBC’s AUM includes $50 billion in multi-asset and notional currency overlay mandates and $41 billion in 3rd party sub-advised assets.

Should your clients work with a top investment firm in Canada?

It depends. Some of the top investment firms or full-service brokerages will only take on clients who have high net worth. For instance, there are firms that require $1 million or more. So, if your clients have a large portfolio and use an investment strategy that is aggressive enough, it might work in their favor.

Plus, some of these firms have a consistent record of giving market-beating returns. They can also provide all-in-one financial services and access to discretionary portfolio management.

Your purpose is to help your clients evaluate whether those benefits align with their financial objectives. If what they’re looking for is more personalized and hands-on guidance beyond the usual offerings, working with a top investment firm might be the right move.

Would you like to read similar articles? Check out our Investment News page for more insights.