Head of BMO WealthPath explains how new interactive, real-time features have helped clients during pandemic

BMO has added new interactive features to its WealthPath financial planning platform, with the upgrades helping forge a stronger connection between advisor and client.

Since launching the platform in 2018, clients have worked with a BMO Private Wealth advisor to build a visual and interactive goal-based plan based on goals and resources.

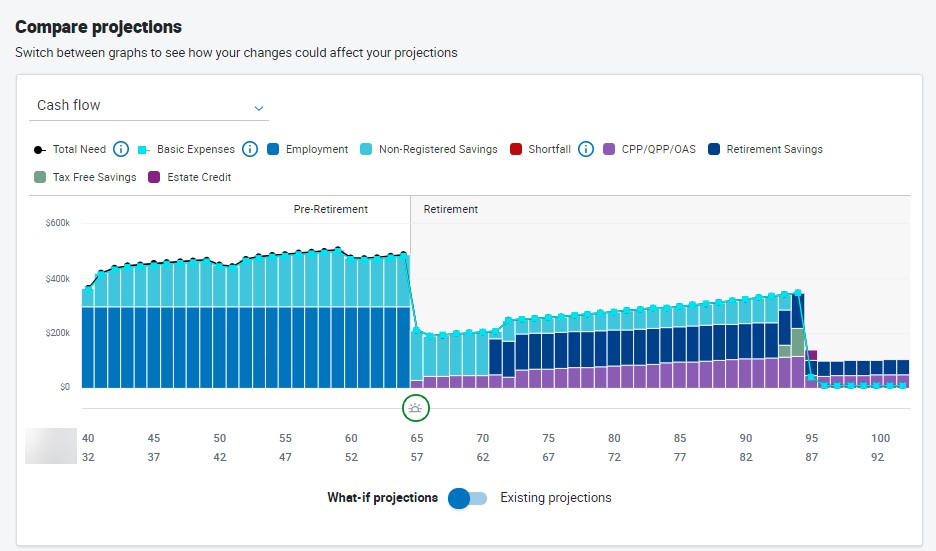

Now clients have online access to their plan after it has been developed, allowing them to test different scenarios to explore how different circumstances and strategies could affect their wealth plan. This may involve removing a lump sum from their portfolio, or changing the time horizon and amount needed to reach a goal.

Caroline Dabu, Head, Wealth Planning and Advisory Services, BMO Financial Group, reflected on how, typically, a plan used to be on average a 15-30-page pdf that was instantly filed away. Any change to a client’s situation would involve alterations and the production of another lengthy document. With the average plan taking an advisor eight hours, it was a wholly inefficient process.

The idea at the outset of BMO WealthPath was to make the planning process a more engaging and interactive experience for both advisor and client. This has borne out – and with the onset of remote working, changes and potential scenarios have been discussed collaboratively over Zoom.

Dabu said: “What differentiates us is we are able to make real-time changes in front of the client to get them more engaged. The conversation has evolved from that printed document to a conversation where we are putting this on an Apple TV in our offices and sitting with a client running these scenarios real time so they can see the impact.

“During the pandemic, it's actually been more relevant than ever, because we're not able to meet with clients for the most part but we have been to co-browse with them.”

COVID-19 has seen an increase in planning conversations and anxiety levels. Dabu said one of the scenario tools that has proved useful in calming stressed investors is one that factors in market crashes. She added: “You're actually able to show a client that even if the market drops, you're still going to be okay over the longer term. It’s been a really useful tool to help our advisors, especially in these volatile markets, and also helps keep the client focused because many people react to those daily swings.”

The client is now able to explore different scenarios on their own time, seeing how different changes affect their future. Variables can be altered to see the impact – from age of retirement, retiring early or downsizing, for example. There’s also a new legacy feature that shows what a client’s projected estate looks like based on mortality events and other factors built into the plan.

If the client is “playing in the sandbox” alone, the advisor will get a trigger to let them know that they have been in the plan, prompting a possible touch point.

The combined effect has been to create a more intuitive, simply tool and to build deeper relationships with advisors, while it’s also equipped for high-net-worth clients and their demands around holding or operating companies.

“The impact has been a much stronger connection between the advisor and the client on their plan. Before it felt like it was such a linear, long process.” She added: “It’s a marriage between digital and advice capabilities. We've certainly seen that it's not digital taking the place of your advisor, but it's a much more collaborative relationship.”

For the advisor, the extra time allows more emphasis on the qualitative side of planning, like incapacity, for example. It also means less time on data construction and more on analysis and where they want to go with the information.

Dabu said BMO set out to reimagine the planning experience because life is not episodic and requires a plan that evolves with the person. WealthPath opens up the option to bring in the bank’s specialists – tax, estate planning or philanthropy – if the situation requires it.

Dabu said: “We’ve also moved up market, making sure that we're addressing our high-net-worth clients with regards to things like corporations and things of that nature. The tool continues to evolve and enhance based on feedback from advisors and clients.”