Why distinct credit fund strategy might just be the fixed-income solution you're looking for

The turbulence usually reserved for the equity markets is now prevalent in fixed income markets, led by continued interest rate volatility and fuelled by recent concerns about banking. In fact, the economic picture painted by interest rate expectations is remarkably dire versus the more hopeful current equity market valuations.

What is a fixed income investor to do?

The asset allocation manual proposes that some sort of exposure to interest rates is an essential part of any portfolio. However, many portfolios moved away from bonds as yields approached zero, finding alternative ways to fulfill the safety, capital preservation and portfolio ballast requirements that a fixed-income allocation has provided in the past. Many have now reinstated bonds in the portfolio, although in a variety of different ways due to meaningfully higher short rates, a severely inverted curve, and the aforementioned rate volatility.

Another fixed-income solution that investment managers have successfully embraced throughout these cycles is a distinct exposure to a high-quality, short-term Canadian credit fund, without exposure to interest rates. They separated their chosen interest rate exposure from their chosen credit exposure. Bank trading desks and hedge funds separate their staff into rates and credit expertise, so why don’t more do it in their fixed income allocations? This idea of “bifurcating the fixed income investment” into rates and credit has proven effective. In fact, Morningstar shows that, dating back to 2015, at least one investment grade Canadian credit fund has outperformed all (300+) traditional fixed income funds, with similar risk metrics to the index.

For clarity, a credit fund works to isolate the credit spread portion of a bond, which is the yield of a corporate bond in excess of the yield of a similar-dated government bond.

To assess the merits of adding a credit fund, you will want to know more about both the credit quality and the current valuation of a fund’s portfolio to determine future performance expectations. In this more volatile environment, it makes sense to consider higher quality credit, therefore investment grade. Measuring the credit quality of a corporate bond issuer gets more difficult as the tenor of the bond increases, therefore shorter-term credit probably makes more sense too. Once short-term and investment grade is established, then you want to assess return expectations. What you’ll find is that short-term, investment grade Canadian credit is currently cheap to historical spread levels, while high yield is only at long-term averages and that Canadian equities are priced well-above long-term moving averages, with skinny risk premiums.

A credit fund currently offers expected returns approaching double digits, including the use of prudent leverage, where expected return also depends upon your choice of daily or monthly liquidity fund parameters. It is likely that a short-term, investment grade credit fund, without exposure to rates, makes almost any portfolio better today, on a risk and a return basis.

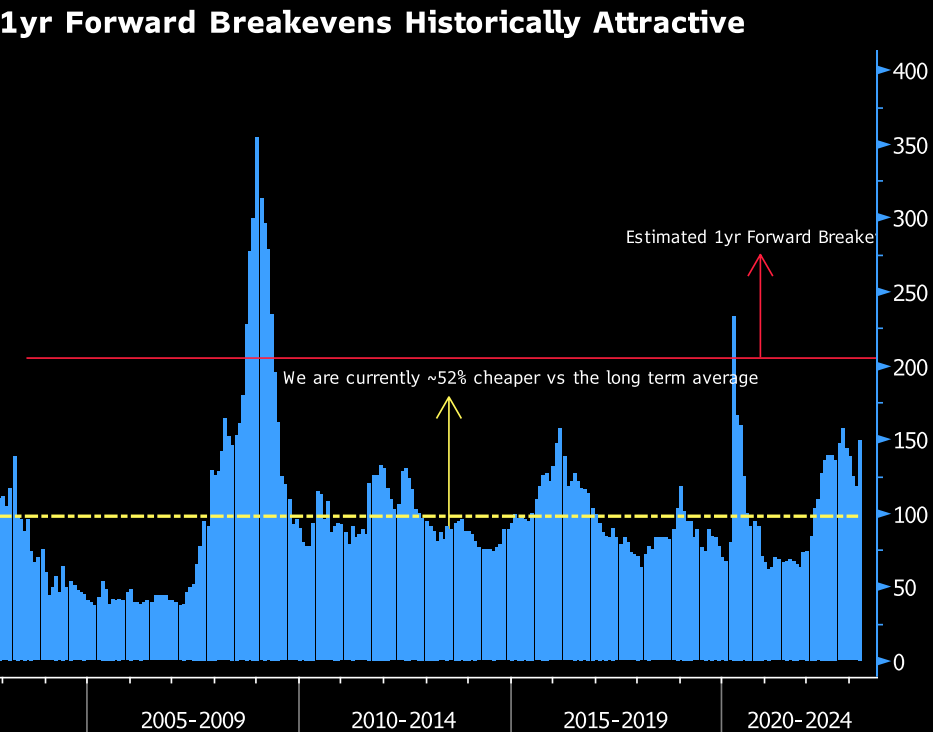

As you will see in the graph of 1-5 year spreads below, the price of corporate bonds expressed in terms of spreads have built in a healthy amount of pessimism for the current economic environment. Credit spreads are roughly 50% wider than their historical average. That relative cheapness creates an opportunity for healthy returns when spreads tighten and a buffer in case of potential economic weakness. To measure that buffer, the graph also shows the 1-year-forward break-even line for this index, which estimates how high credit spreads can go, on average in the next year, before this index stops delivering positive return. Some Canadian credit funds offer an even greater break-even buffer, only ceasing to produce returns should spreads double, on average, from these already elevated levels. You will notice that spreads doubling from here would reflect a true crisis scenario, and therefore unlikely.

Bloomberg Canada- Corporate 1-5yr Index, March 27, 2023

Some Credit Funds offer running yields that support high-single-digit return expectations, built on cheap spreads versus history, and a healthy break-even scenario. Historical credit fund volatility is in line with traditional fixed income indices, and far lower than equities. A distinct credit fund exposure might just be the fixed income solution, or the absolute return strategy, that you are looking for.

Kevin Foley is a Managing Director, Institutional Accounts, YTM Capital Asset Management. Kevin spent two decades in Capital Markets at a major Canadian bank and sits on several Canadian Foundation Boards and Investment Committees.