Natixis IM survey of those responsible for fund selection and portfolio construction in North America are expecting more volatility

Investors in Canada and the US are overexposed to risky assets according to some of North America’s top wealth professionals.

A new survey from Natixis Investment Managers, reveals that 80% of the fund selectors and portfolio constructors at the region’s leading wealth management firms, private banks and wirehouses, believe investors have taken on too much portfolio risk in the current rate environment.

With distorted stock values and decimated bond yields, respondents are calling on investors to reposition their portfolios for higher central bank interest rates, normalized markets, and a world that is living with COVID.

Volatility is expected by most respondents in the stock (78%) and bond (71%) markets and 7 in 10 say frequent portfolio rebalancing will be important as markets churn.

Inflation and rates (76% each) are considered the top market risks while volatility (51%) and valuations (49%) are also potential negatives.

The survey also found that 86% of fund selectors believe high valuations are distorted by super-low rates and don’t reflect company fundamentals (66%) and 71% think the stock market has grown at a rate that isn’t sustainable.

Opportunities in 2022

However, it’s not all bad. There are several ways that investors can position their portfolios for success according to the fund selectors, with 75% saying that market conditions will favour more active management:

- They expect better returns on the reopening trade (74%) than the stay-at-home trade (26%); value (68%) over growth (33%) stocks; and small cap (58%) over large cap (42%) companies.

- Most (73%) think Big Tech will remain big and continue to grow unabated.

- They recommend tactical rotations to more economically sensitive and value-oriented sectors. Key calls underscore their conviction in the reopening trade and favor: Financials, energy, healthcare, consumer discretionary and information technology.

- They are divided on whether growth is more likely to come from developed markets (49%) or emerging markets (51%); however, 74% agree that emerging market investments are overly dependent on China, and 86% feel that regulatory uncertainties in China make the country a less attractive investment opportunity.

- They remain committed to the important role fixed income plays in client portfolios, though 88% agree it will be important to counter duration risk as rates begin to normalize. With rates still at historically low levels, 72% of fund selectors are increasingly recommending alternative strategies to generate yield.

Model portfolios

The survey also revealed that most wealth managers believe that model portfolios will play a more important role this year.

“Given concerns about increased volatility, fund selectors are clearly telling us that model portfolios are likely to take a prominent place in plans for 2022 as they look to present an integrated, risk-based solution that can help investors navigate a riskier market environment,” said Dave Goodsell, executive director of Natixis IM’s Center for Investor Insight. “At the same time, many are looking to complement their core model offering with non-correlated investments and other specialized strategies.”

In the next two years, fund selectors plan to add:

- Model portfolios: 84% of fund selectors currently offer model portfolios and 57% of those report a growing need for specialty models to complement their core portfolios. The top sleeves or strategies they plan to add include models focused on tax management (43%), alternatives (40%), ESG-focus (37%) and income generation (35%).

- ESG investments: 58% are adding more ESG-focused investment options. More than half (55%) say consideration of ESG factors is an integral part of sound investing, and the same percentage (55%) also agree there is alpha to be found ESG investments.

- Private assets: 52% plan to add more private investment investments, where 74% say there is a significant delta in returns from the public markets. They see the most attractive areas for private equity investments as: infrastructure, information technology, healthcare and real estate

Cryptos remain relevant but risky

More than 4 in 10 respondents said they feel under pressure to offer cryptocurrencies, mainly to appeal to younger investors.

However, more than two thirds of fund selectors don’t think individual investors should have exposure to cryptocurrency and 86% agree that these assets need to be more transparent.

Regulatory oversight is believed to be necessary by 84% and 71% say their firm needs more education in digital assets and cryptocurrencies before investing in them.

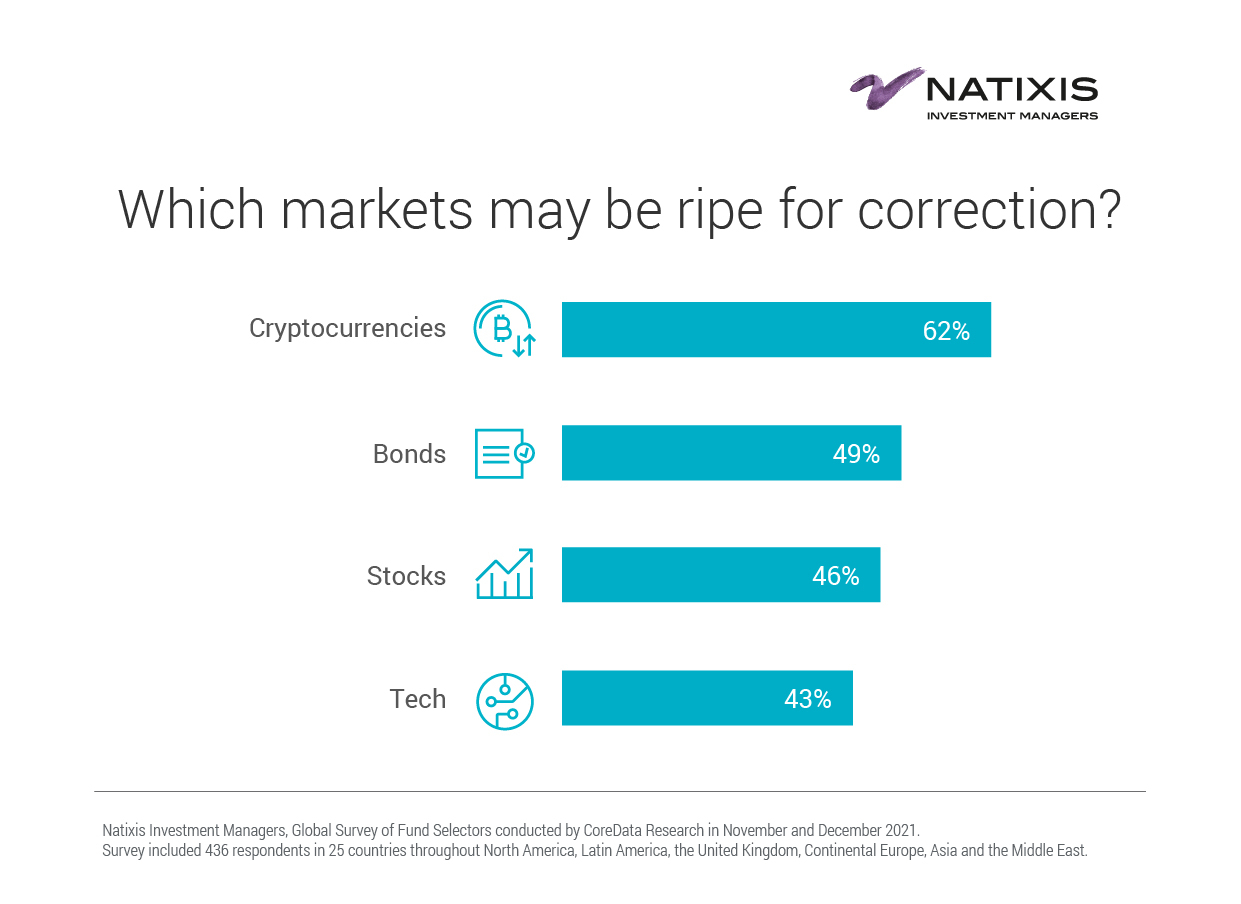

Cryptos are seen as the asset most at risk of correction in 2022 (62%) followed by bonds (49%), stocks (46%), and tech (43%).