Report highlights the dilemma of today’s young Canadians

Buying a home should not mean tough times later in life but the high cost of Canadian homes is giving would-be buyers a tough choice.

For many millennials at the prime homebuying age, achieving their ownership dream will leave them with years of fear that they won’t be able to save enough for their retirement.

This is a key element of additional findings from the KPMG Millennials and Retirement poll which found that 54% of millennials will never be able to afford a home; and 42% of those who already do have delayed retirement savings to hold down a mortgage.

"The financial future for millennials is vastly different from that of previous generations," says KPMG's Martin Joyce, Partner, National Leader, Human & Social Services. "They face unique challenges when it comes to building wealth despite having more education and income, primarily because of housing unaffordability.”

While 78% of respondents of all ages still believe that homeownership is an investment for financial stability in retirement, there is concern among millennials that they can’t rely on a home being the nest egg it was for their parents’ generation.

"What we are seeing is that millennials face a choice today that their parents' generation didn't," says Mr. Joyce. "They either buy a home or focus on saving for retirement. Buying a home involves taking on considerable debt because house prices are so high in relation to incomes, and that limits millennials' ability to save. While most feel home ownership is an investment for financial stability, they worry their home will be worth less in the future."

Additional findings

Other key poll findings include:

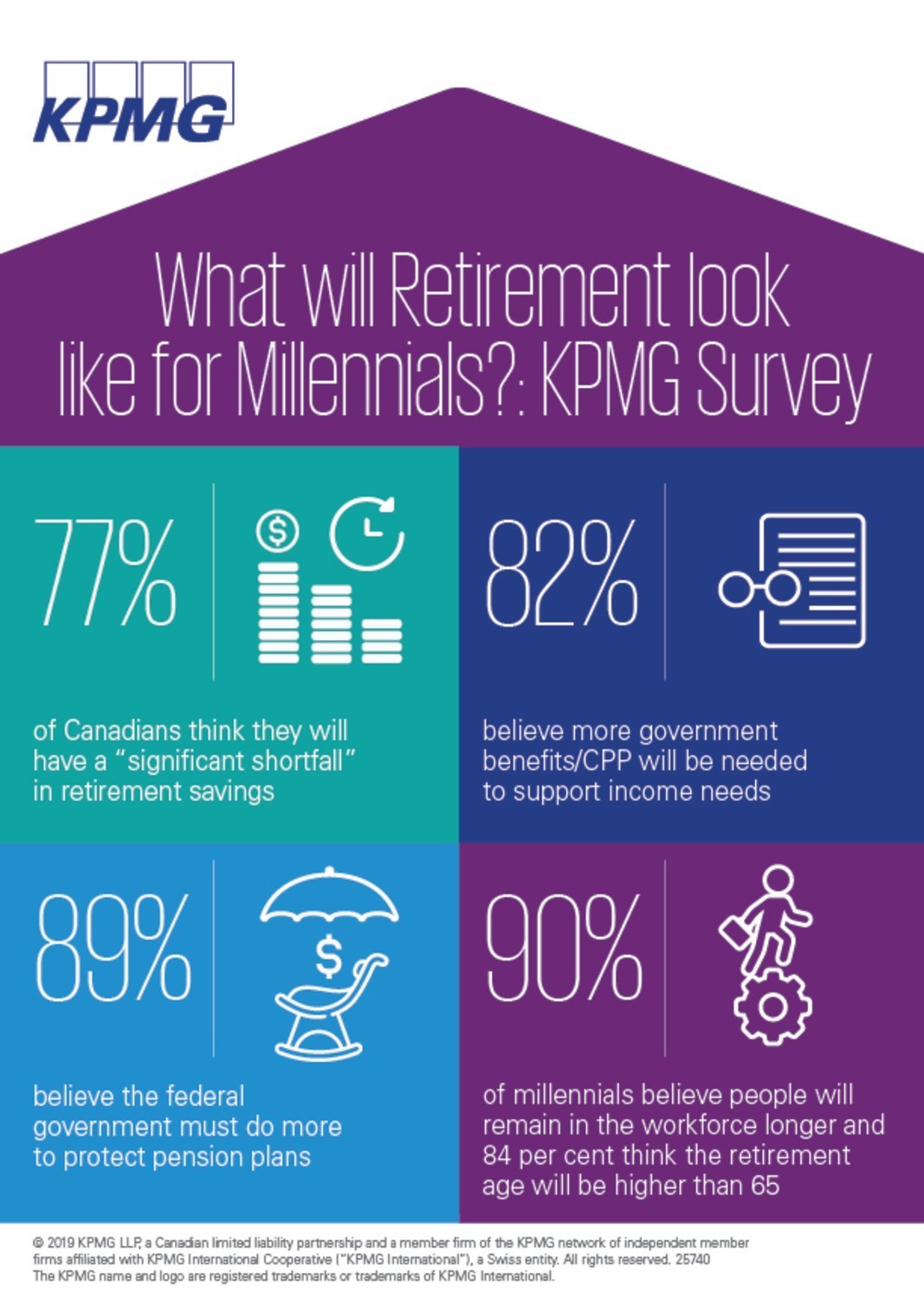

- 77% of all age groups think there will be a "significant shortfall" in retirement savings;

- 82% say more government benefits/CPP will be needed to support income needs;

- 89% believe the federal government must do more to protect pension plans for Canadians;

- 83% believe Canada will need to overhaul its public and private pension and retirement savings systems; and,

- Nearly all (90%) of millennials believe people will remain in the workforce longer and 84% think the retirement age will be higher than 65.