A shift in customer expectations could be costly for banks unless they step up the trust proposition

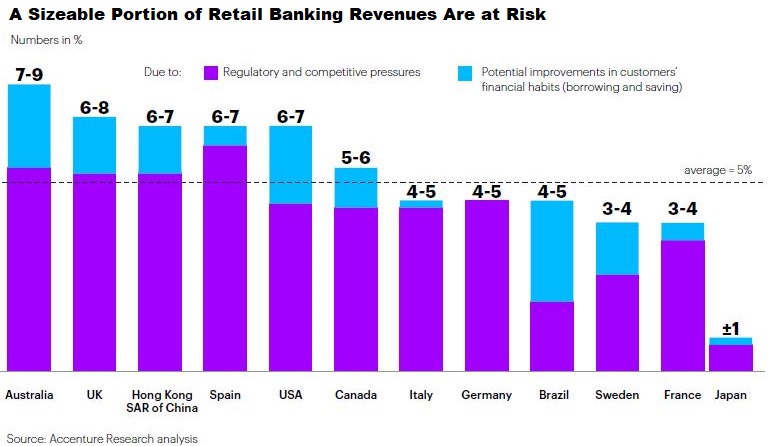

There’s some bad news for Canadian banks in a new study published today (March 11) – their revenues are set to fall more than 5% in the coming years.

That’s because incumbent banks globally are facing a double-barrel shot from regulatory changes and new competitors enticing customers with no-fee propositions. Some have even suggested banks face extinction without transformation.

The study by Accenture puts the impact on revenue as Canadian banks are forced to cut fees at 5.6%, above the 5% global average but behind the 6.7% hit that US banks are expected to take.

“Whether in one year or five, the billions in revenues that traditional banks collect annually for basic services and penalties, like overdraft fees, will erode,” said Alan McIntyre, senior managing director and global head of Accenture’s Banking practice.

Advice is king

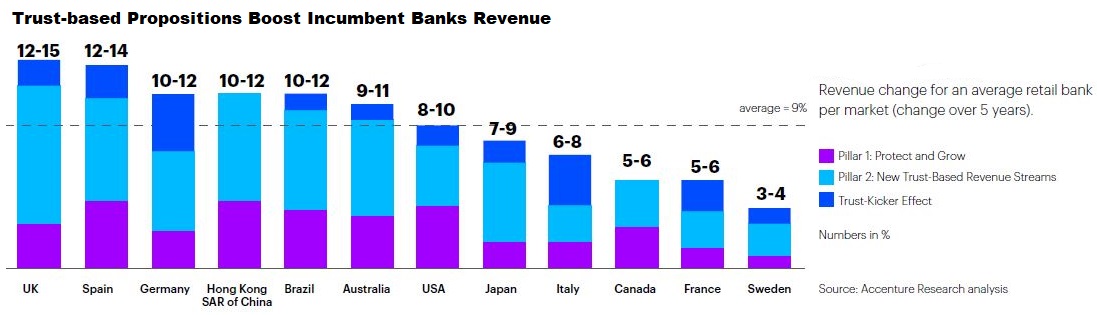

The good news from the study is that banks have a way to mitigate the lost revenue through providing customers with the best advice to manage their finances.

By boosting customers’ trust in them – including innovative use of technology such as artificial intelligence and predictive analytics – Canadian banks could boost their revenues by 5.6%, erasing the predicted loss from fees. Globally banks could see a 9% boost.

“Banks that proactively cannibalize this diminishing revenue by helping customers manage their money better will earn their trust, which benefits both parties. The economic logic is simple: Better advice leads to better customer decisions, which create more wealth over time — more wealth for banks to help manage,” added McIntyre.

Banks that are able to improve their trust proposition will benefit from customer loyalty and be able to attract the best talent.

They are also positioned to increase revenues as 55% of consumers surveyed said they would be willing to pay a fee for relevant add-on services from their bank such as advising on payment options for large items or how to generate the highest rewards from their spending.

The full study is available at: https://www.accenture.com/us-en/insights/banking/purpose-driven-banking-win-customer-trust