This year's trend that favours ETFs over mutual funds continued in November according to the latest stats

The trajectory of Canadian investment funds continued on trend in November with ETFs cementing their superiority among investors.

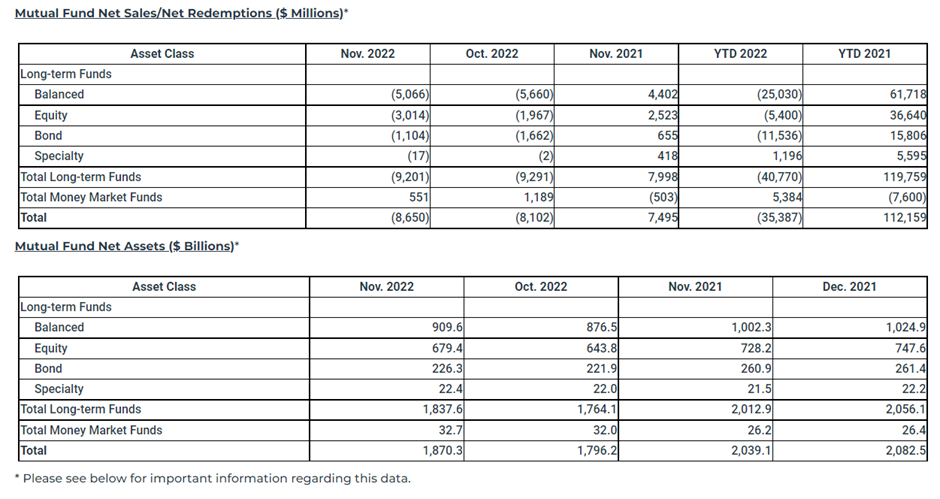

Mutual funds posted another month of net redemptions, with the $8.7 billion figure growing from $8 billion in October, according to the Investment Funds Institute of Canada (IFIC).

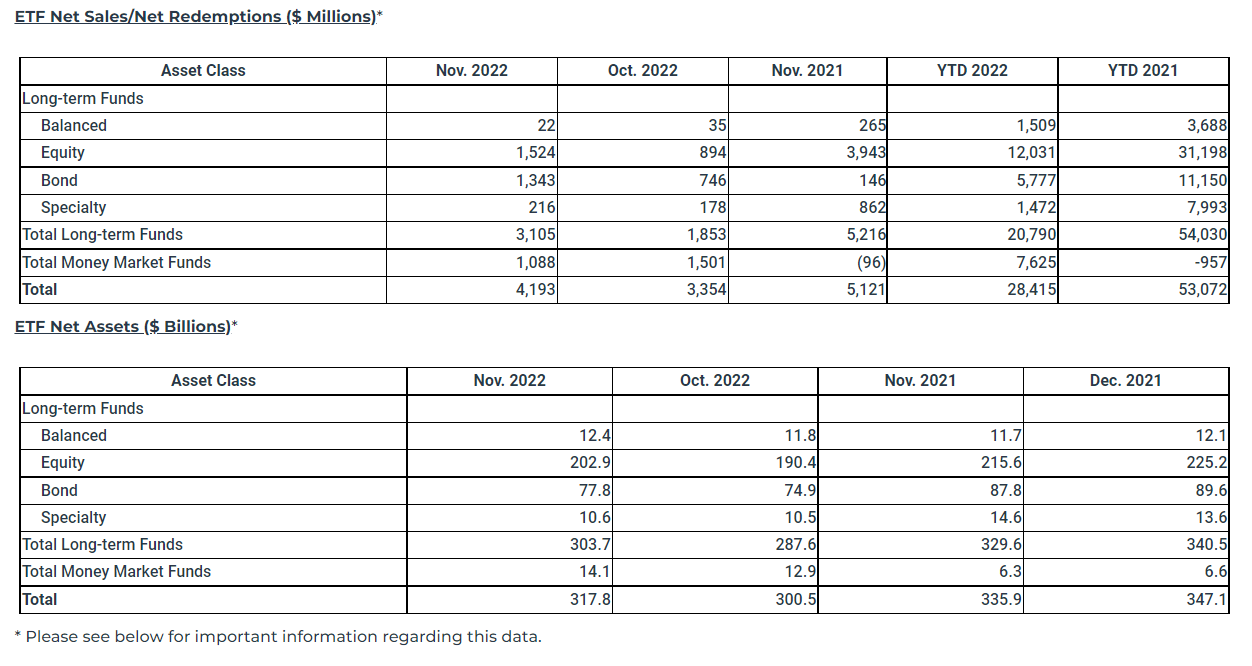

Meanwhile, exchange-traded funds (ETFs) maintained their popularity with net sales of $4.2 billion, just above October’s $4 billion.

For mutual funds, long-term balanced funds led the divestment at $5 billion, roughly in line with the previous month; while equity funds saw a larger exodus ($3 billion) compared to October ($1.9 billion).

There were also sizeable redemptions of bond funds ($1.1 billion) and a small pullback from speciality funds ($17 million).

Money market funds posted $551 million in net sales.

Mutual fund assets totalled $1.870 trillion at the end of November 2022. Assets increased by $74.1 billion or 4.1% compared to October 2022.

The trend in the Canadian funds market is mirrored in the global market according to a new analysis from Bloomberg Intelligence.

ETFs gain again

For ETFs, there were no categories with net redemptions.

Long-term funds posted net sales of $3.1 billion, led by equity ($1.5 billion) and bonds ($1.3 billion), with specialty ($216 million) and balanced funds ($22 million) also ending the month positive.

Total money market funds recorded net sales of more than $1 billion in November.

ETF assets totalled $317.8 billion at the end of November 2022. Assets increased by $17.2 billion or 5.7% compared to October 2022.

* Important Information Regarding Investment Fund Data:

1. Mutual fund data is adjusted to remove double counting arising from mutual funds that invest in other mutual funds.

2. Starting with January 2022 data, ETF data is adjusted to remove double counting arising from Canadian-listed ETFs that invest in units of other Canadian-listed ETFs. Any references to IFIC ETF assets and sales figures prior to 2022 data should indicate that the data has not been adjusted for ETF of ETF double counting.

3. The Balanced Funds category includes funds that invest directly in a mix of stocks and bonds or obtain exposure through investing in other funds.

4. Mutual fund data reflects the investment activity of Canadian retail investors.

5. ETF data reflects the investment activity of Canadian retail and institutional investors.