President at Wealth Tech firm explains why incorporating more variables into planning software can result in more dynamic plans and greater client fulfillment

The fundamental problem in financial planning platforms may stem from the deeply subjective and personal nature of client’s lives. Take the example of a Registered Disability Savings Plan (RDSP). It’s a registered account that only a small portion of the population will ever need. But for those who do need them — parents of children with disabilities, for example — a financial plan that can’t integrate an RDSP is an incomplete plan and a plan that has, effectively, zero value.

“Whatever the client’s circumstances are, be they lifestyle or financial, you have to model them properly,” says Michael Curtis, President of Vision Systems Corp.

Vision Systems Corp is a wealth technology provider with three separate planning platforms: Vision Works Life Planner for individuals, Corp Works Corporation Planner for private corporations, and Trust Works Trust Planner for personal trusts. Curtis explains that his firm’s goal across all three products is to achieve “completeness” in the planning platforms they offer advisors. The result, he says, is technology that offers “life planning” rather than just financial planning.

“There are some things in life that decidedly change over time. Things like taking vacations, at a certain age you’re not taking them anymore. Or vehicles, at a certain point you go from a two-vehicle family to a one-vehicle family, then quit driving altogether. You’ll find in a lot of financial planning software that many of the entries are assumed to continue over time. In life planning, you build in more itemization with the notion that things will change over time, what we call a dynamic database.”

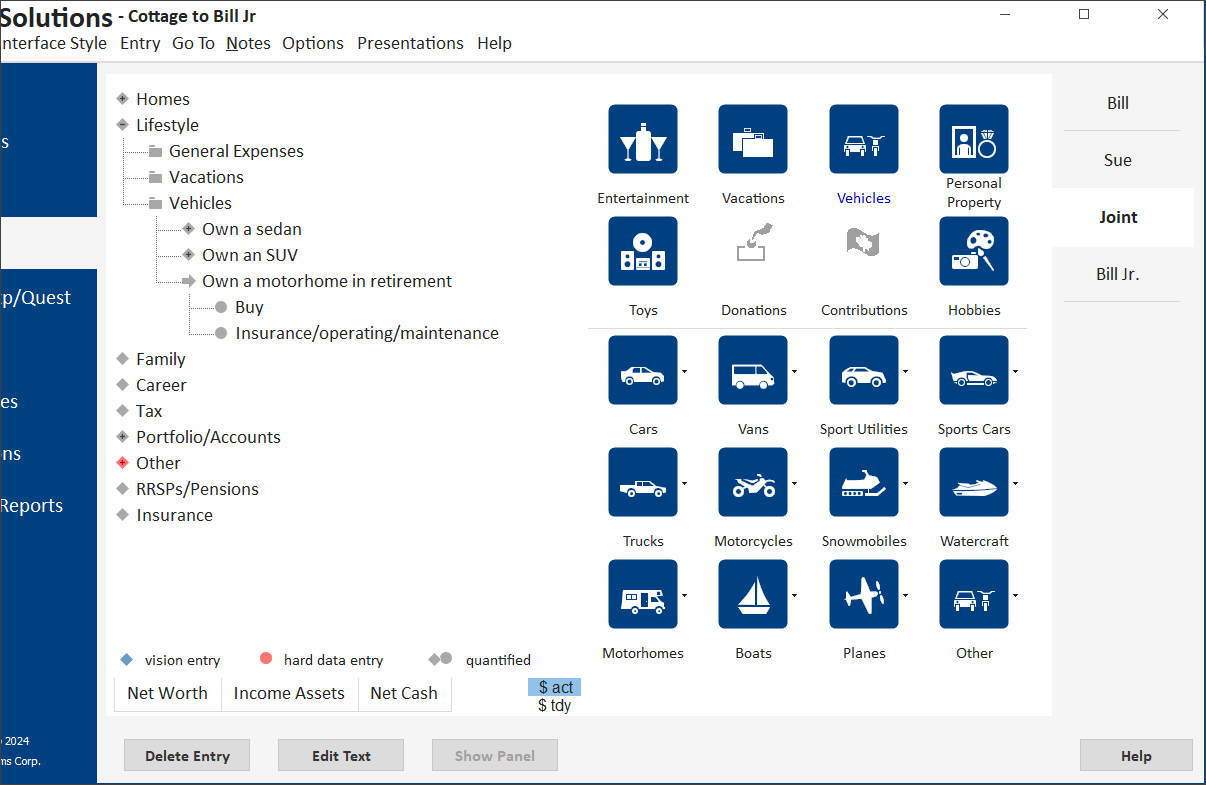

Curtis explains that Vision Systems builds each client’s dynamic database using visual queues that spark different mental pathways and prompt clients to offer other important pieces of data that might not come up in a normal conversation with their advisor. Curtis uses the vehicle example again, noting that if an advisor just asks their client what they drive, they’ll hear back something like ‘a sedan and an SUV’ but when the client is given visual cues by means of a button palette with various icons, including every kind of vehicle, they might be prompted to say ‘we’re planning to get a motor home in retirement.’ The platform, Curtis notes, offers advisors different ways to stimulate planning conversations so they can input enough data to achieve a more complete picture of a client’s vision of the life they want.

An example of the button palette clients are offered to stimulate thought pathways

That complete life plan can then inform strategies around both accumulation and decumulation that clients are in need of. It can help house-rich cash-poor high earning clients rein in spending and save better. It can help give some spending confidence to retirees who may be needlessly conservative about spending out of fear they’ll outlive their savings. By addressing each input and including a complete set of the variables involved in a client’s life, the platform can help those clients gain a clear picture of what they can and can’t do to achieve their goals.

Maintaining that level of dynamic data and completeness isn’t easy. The recently announced plan in the 2024 budget to raise the Capital Gains inclusion rate to 66 per cent for gains over $250,000 — and for all cap gains in corporations or trusts — reset many clients’ plans across Canada. Curtis says he and his team spent three weeks integrating these new inclusion rates into their software suite, ensuring they applied to each relevant category. Given that this new inclusion rate is set to come into effect on June 25th, they’ve ensured the software can account for capital gains before the application of the rule as well as future cap gains after the 25th. Curtis says that this allows advisors to create unlimited what if scenarios, with clients, applying different policy rates and different decisions around the timing of asset sales to their life plans.

Integrating these new policy changes into the platform can also help advisors communicate with their clients. Given the level of anxiety and uncertainty the new inclusion rate has introduced, advisors can quickly apply the new rate to their client’s unique financial situation and show them in hard numbers whether it will meaningfully apply to them or not. The platform serves as a form of triage, allowing advisors to organize their clients from most to least impacted and budget their time and efforts accordingly.

It's that ability to facilitate and open conversations with clients for advisors that Curtis believes is the greatest value of his platform. As technology makes it easier and easier for clients to manage the dollars and cents of their financial lives, an advisor’s value will come from integrating those wider life considerations into the financial picture.

“We’re on the major shift where the value add for clients is no longer going to be the best mathematical answer, because with software they’ll be able to click a button and get that answer,” Curtis says. “The real value add is sitting down with people and getting them more emotionally involved in the planning process.”