Looking for the best RRSP rates in Canada? Learn how you can guide your clients to smarter savings and stronger long-term retirement outcomes

Helping clients grow their retirement savings is a major part of financial planning. One way to do this is by securing the best rate for their Registered Retirement Savings Plan (RRSP). With interest rates constantly fluctuating, financial advisors need to stay updated on which banks, credit unions, or online platforms are offering the most competitive options.

In this article, Wealth Professional Canada will explore the best RRSP rate available today. We’ll look at some of the basics of RRSP to help aspiring and new financial advisors understand how it works. Then, we’ll compare the best RRSP savings accounts in the country. We’ll also highlight some of RRSP’s features and provide valuable insights, so you can better help your clients in navigating this retirement planning tool.

What is an RRSP?

An RRSP is a government-registered investment account designed to help your clients save for retirement in a tax-efficient way. Contributions are tax-deductible, which can reduce their annual taxable income. Investment growth inside the RRSP is tax-deferred until withdrawal.

Ideally, your clients should contribute regularly to their RRSP throughout their working years. When they retire, the funds can be converted into a Registered Retirement Income Fund (RRIF). This can be used to purchase an annuity or withdraw as a lump sum. However, there are different tax implications for each option.

How does an RRSP work?

Anyone under the age of 71 who has earned income and reported it in the previous tax year is eligible to open an RRSP account.

Your clients should make contributions before the end of each tax year. This allows their RRSP investments to grow tax-deferred until they are ready to make a withdrawal.

When your clients withdraw funds, the amount is taxed as regular income in the year it is taken out. The exceptions are withdrawals made through either of these two:

- Home Buyers’ Plan (HBP)

- Lifelong Learning Plan (LLP)

Both options will allow your clients to access their RRSP savings temporarily without immediate tax, provided repayments are made on time.

Want to know more about RRSP in Canada? Watch this:

You can also share this article with your clients in case they ever overcontribute to their RRSPs.

Best RRSP rates in Canada

We've listed four of the best RRSP rates in the country:

- EQ Bank RSP Savings Account

- Motusbank RRSP Savings Account

- Alterna Bank RRSP eSavings Account

- Tangerine Bank RSP Savings Account

Let's take a closer look at each:

1. EQ Bank RSP Savings Account

EQ Bank’s RSP Savings Account offers your clients a 1.75 percent annual percentage yield (APY) on every dollar they contribute. There are no fees, and no minimum balance is required. Contributions are tax deferred.

Your clients can grow their savings further with EQ Bank’s RSP GICs. These currently offer 3.5 percent for a one-year term and 3.55 percent for a two-year term. However, the GICs are non-redeemable, meaning the funds are locked in until maturity.

To access this account, your clients must first open an EQ Bank Savings Plus Account. This setup also involves using EQ Bank for regular savings and day-to-day banking.

2. Motusbank RRSP Savings Account

Your clients can open an account with Motusbank online and start earning 2.5 percent interest on all deposits right away. The account has features like:

- no minimum deposit

- no monthly fees

- no fees for moving money in or out

To complement the RRSP savings account, Motusbank offers a no-fee chequing account that also earns a small amount of interest. Your clients can also open a Tax-Free Savings Account (TFSA) and non-registered savings accounts.

If they want to grow their RRSP even more, they can invest in Motusbank’s RRSP Guaranteed Investment Certificates (GICs). These currently offer rates of up to 4.4 percent.

Motusbank accounts are eligible for CDIC insurance. All services are available through online, mobile, and telephone banking, but there are no physical branches or in-person service.

Read next: RRSPs vs. TFSAs: What's better for your clients?

3. Alterna Bank Registered Retirement eSavings Account

Alterna Bank is a digital bank that offers competitive rates for those who are interested in building their retirement savings. Its Registered Retirement eSavings Account earns two percent interest on every dollar, with no monthly fees. There’s also no minimum balance required.

For added convenience, Alterna also provides a no-fee chequing account. Your clients can use it to transfer funds to and from their RRSP eSavings Account without charge.

To boost retirement savings further, clients can invest in Alterna’s RRSP term deposits, which offer rates up to 4.15 percent.

4. Tangerine Bank RSP Savings Account

Tangerine Bank is widely recognized as one of the country’s leading digital banks. It offers a full suite of personal banking products including:

- loans

- mortgages

- credit cards

- investment products

- savings and chequing accounts

For clients looking at RRSPs, Tangerine’s RSP Savings Account offers 0.30 percent annual interest. While this rate is relatively low, it still provides some flexibility. Your clients can move money between the RSP account and their Tangerine chequing account or transfer it to another financial institution. Just make sure that they understand the tax consequences of withdrawing from an RRSP.

Tangerine also offers RRSP GICs with rates of up to 4.7 percent starting with a $1,000 minimum investment. Your clients can also go for Tangerine Bank’s RRSP loans to top up their contributions before the tax deadline.

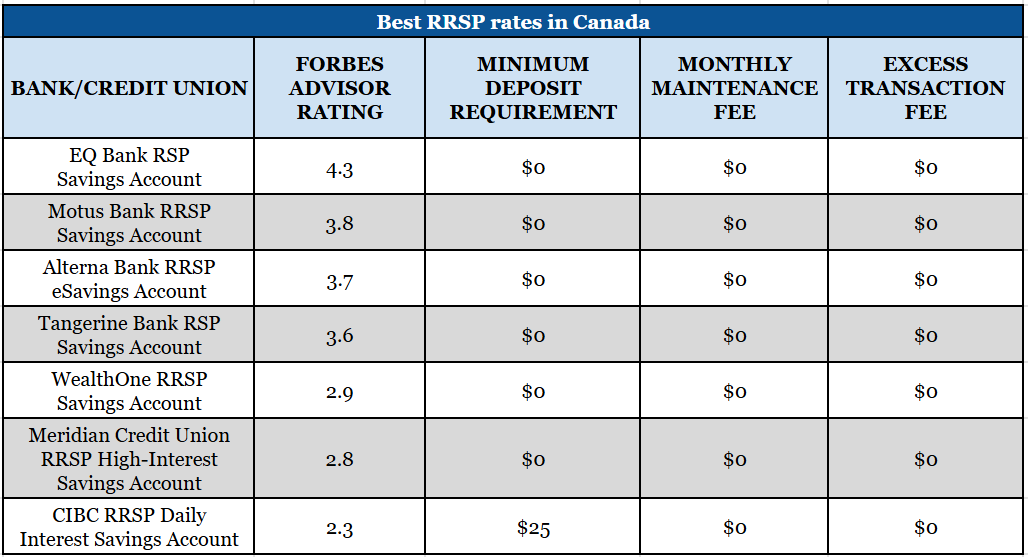

Check out this comparative table showing the best RRSP rates in Canada from various banks or credit unions according to a report by Forbes:

What is the average rate of return on an RRSP?

The average annual return on an RRSP varies based on the investment mix. For example, a balanced portfolio might yield less than a growth-oriented portfolio. Returns can fluctuate depending on market conditions and investment choices.

What is the 3-year rule for RRSP?

The attribution rule applies to the three-year period following a contribution to a spousal RRSP. If a withdrawal is made from the spousal RRSP within that period, the amount is taxed as income to the contributor rather than the annuitant.

To avoid this, no contributions should be made to any spousal RRSPs in the year of withdrawal or the two preceding years.

Can an RRSP be withdrawn at any time?

As long as your clients’ plans are not locked in, they can withdraw their RRSP contribution at any time without paying any penalty. However, their funds will be subject to withholding tax. The total amount needs to be considered income when your clients file their taxes.

There are situations where RRSP contributions are tax deferred. A good example is the purchase of a first-time property under HBP or financing for education under LLP. In each case, no withholding tax is collected. The withdrawal shall not be considered income if paid to the RRSP within the required periods.

Your clients can also withdraw their RRSP contribution and transfer it into an RRIF once they reach 55 years old. This strategy appeals to higher earners because it allows them to postpone paying taxes until after retirement, when their earnings are often smaller.

How risky is an RRSP?

The RRSP alone is not naturally risky. The level of risk associated with it only depends on the type of investment that your clients choose. Investments made through RRSPs might come under these different risk categories:

Low-risk options

The types of investments under this category often include:

- GICs

- savings accounts

- government bonds

While these options have lesser potential returns, they are considered safer due to government guarantees or being stored in secure financial institutions.

Moderate-risk options

This category includes mutual funds, which combine funds from different investors to invest in a broad portfolio of bonds and stock investments. The level of risk differs based on the type of mutual fund and its asset allocation.

High-risk options

Because of the potential for increased fluctuations, stocks and equity-centred investments are often seen as higher risk. The performance of the stock market might fluctuate rapidly in short periods of time. This can result in both possible gains and losses.

Helping your clients secure the best RRSP rate

Choosing the right RRSP account can have a big impact on your clients’ long-term savings. Some might prefer a higher-interest GIC with a locked-in term. Other clients might want flexibility through a no-fee RRSP savings account. Either way, earning a competitive rate helps their money grow faster.

As their trusted financial advisor, it’s worth comparing offers from the institutions mentioned above. These providers currently lead the market with attractive rates and low fees. Helping your clients choose the right account today puts them in a better position for retirement income tomorrow.

Do you have clients who are planning for retirement? Read similar articles about RRSP and more on our Retirement Solutions page.