Kevin Foley explains why he thinks central banks haven’t pivoted, but advisors can

Most individual and institutional investors are at least unsettled with regards to their fixed income investments, and the better investors have successfully rebuilt their portfolios because of it.

The XBB exchange traded fund mirrors the Canadian Universe Bond Index. It has lost 3.21% year-to-date, lost 3.0% annually over the past 3 years, and it returned a measly 0.65% per year over the past five years. That performance and the meagre current yields have hurt portfolios and forced investors to adopt better solutions than traditional bonds and bond funds. Bond yields are higher, but they are not high, and in a portfolio context they are unproductive.

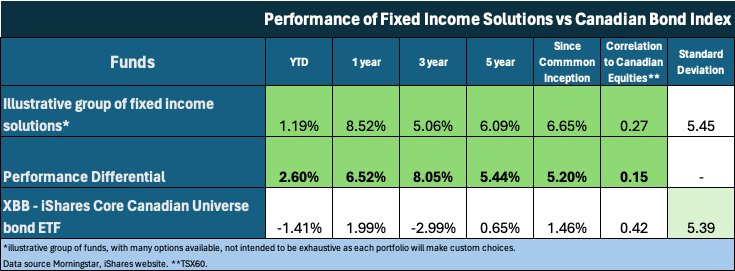

The very good news is that that script can be flipped, where fixed income becomes a portfolio driver. To borrow from recent headlines, a fixed income pivot has occurred, into funds that replace and/or complement traditional fixed income bond investing. These funds offer enviable track records, compelling reward-for-risk-taken, and robust expected returns, as can be seen in the chart below.

The consternation over fixed income investing stems from a multitude of sources, including a general lack of fixed income knowledge, current low yields after the many years of disappointing returns, the notion that equities are the exciting part of the portfolio, and more recently the realization that simply buying bonds for your fixed income allocation is no longer optimal, or even recommended. Individuals and professionals have used bonds to solve for the fixed income needs of a portfolio for a long, long time, and just like UBER, streaming services, and AI, things evolve.

On one hand the world seems to be in a rush for interest rates to fall, yet the current five-year and long bond yields of 3.65% and 3.40% don’t feel overly compelling, nor effective for a portfolio. After an historic interest rate rising campaign from near-zero yields, the headlines have declared that central bankers have pivoted, and we’re bombarded with conflicting views on the timing and speed with which those central bankers will begin to lower interest rates. However, the central bankers have so far only stopped raising interest rates, while that pivot declaration would seem to require those bankers to actually lower rates. Call it a pause perhaps? Confusing stuff.

Most current portfolio target returns seem to fall into the 6-8% range, rendering bonds an immediate drag on the portfolio. If you put the textbook 35-40% of your portfolio to work at 3.50% in bonds, how much do you need to earn on the other 60% of the portfolio to get to 6.5%-8% total? A lot. Can my portfolio endure that amount of risk? How comfortable am I with the outlook for the riskier equity / growth part of my portfolio?

I happen to be involved with a foundation investment committee, where we recently met with a host professional investment management service providers. I find it telling that every one of them has suggested a target return for our medium-risk foundation in the 6.5-8% range, and that every one of them has the allocation to bonds far below that traditional 35-40% range, fully embracing new fixed income solutions to meet return objectives within prudent risk limits. Most of those solutions are noted below.

Frustratingly, when investors do endeavor to learn more about bonds, and subsequently get discouraged when trying to buy individual bonds at posted yields or get lured into guaranteed investment certificates with seemingly good risk/reward yet little awareness of the inherent illiquidity and reinvestment risk, they get turned off fixed income yet again. Then they tend to canvass the name brand bond managers to select a bond fund only to run into core, core+, strategic, global, yield enhanced, high yield, private and on and on labels that mostly tend to do similar things including “shortening duration to protect from rising rates”, which is akin to smoking a little less.

Some investors do understand the notion that bond prices go up when interest rates go down, and that what is good for the economy is often bad for bond prices, and that most bonds trade over-the-counter rather than on an exchange, and that a corporate bond’s yield is the sum of a government bond yield and a credit spread. Yet too few do understand fixed income and those that don’t are loath to expose that fact, so they tend not to ask, choose poorly, and simply move on. Frustrating, unfortunate, and unnecessary since there are proven partners who can help.

Good investment advisors and good fixed income managers can help with a lot of that, but the reality is that there is only so much that even good managers can do with traditional bonds, and the fixed income part of a portfolio can’t just relent and accept that. The 35-40% of a portfolio that the textbook tells you should be in fixed income is there for more than its return alone. It is indeed there to generate an effective return while it also reduces total portfolio risk and performs when the equity / growth part of the portfolio underperforms. Fixed income needs to produce income, create safety, cause diversification, and provide portfolio ballast.

The good news. Leading advisors, pension funds, and consultants like the ones I mentioned above have re-established the make-up of an effective fixed income allocation. One might say they have pivoted the fixed income allocation, thereby improving the total portfolio. If interest rates were much higher, where they could produce sufficient return and where their yield had sufficient room to fall (which causes bond prices to rise) when needed to effectively offset weakness in equities, maybe then those experts will call for more than the current 5-10% in bonds. Until then, this updated 35-40% of the portfolio called fixed income should be a personalized selection of several of the following investments: distinct interest rate exposure, distinct corporate credit exposure, mortgages, real estate, infrastructure, and private debt. It may also include a small allocation to high yield bonds, the right market-neutral equity strategy, and potentially a portfolio of blue-chip dividend stocks as a substitute for traditional fixed income. A simple example of the performance, volatility and correlation stats for these type of funds is illustrated in the chart above.

It's worth noting that some fixed income managers have developed the tools and expertise to use bonds while delivering beneficial exposures for a portfolio as a replacement for a bond or traditional bond fund. They are often referred to as fixed income alternatives. For example, these funds can eliminate the effect of the volatile interest rate portion of a bond, while delivering coveted and less volatile exposure to Canadian corporate credit spreads. These funds have proven to perform in all interest rate environments, not only when rates are stable or falling like traditional bond funds require.

The right combination of those fixed income solutions can produce an expected return of 7% or more, while some of the solutions above returned more than 10% last year, and have outperformed bonds by 5+% over many years. The right allocation produces reasonable risk and low volatility, which then reduces what is required from both returns and diversification within the equity allocation. The right fixed income combination can effectively diversify a portfolio, decreasing correlation metrics, and setup the portfolio to be resilient during challenging times. That feels like an actual and effective pivot, and a refreshing approach.

It is important to note that these changes to the make-up of the fixed income portfolio, including the addition of equity securities with fixed income-like characteristics, may affect total portfolio risk and may require shifts within the equity/growth part of the portfolio too. Note that if the fixed income portion now generates higher returns, then the equity portion may not need to take as much risk, and also note that the portfolio-enhancing diversification produced by the more effective fixed income allocations may in fact create new opportunity to take more risk within the equity allocations.

Pivot your approach to fixed income, just like so many of the leading experts have, and improve your total portfolio while increasing your total return.

If you continue to fixate on bonds when you plan a fixed income allocation, you’re destined to underperform for a while longer. If you are willing to pivot to an updated and diversified fixed income exposure, you are likely to increase total portfolio returns, likely to reduce total portfolio risk and you will likely earn the luxury of requiring less from your equity/growth investments. Let a refreshed fixed income allocation flip your script.