Jump to winners | Jump to methodology

Canada’s western provinces may be far from the nation’s financial capital, but they are home to a thriving and active body of investors.

Wealth Professional’s 5-Star Advisors – Western Canada 2023 report recognizes the financial advisors who cater for and guide the investors in this part of the country encompassing the provinces of Manitoba, Saskatchewan, Alberta, and British Columbia.

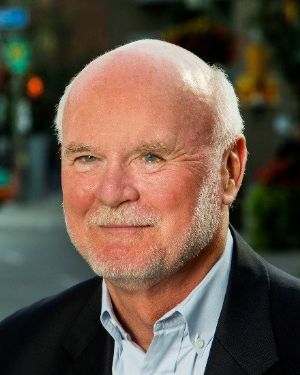

“Toronto is like our New York – very C-suite-oriented, very public-markets-oriented,” says award winner Thane Stenner, “whereas Western Canada is a little bit more flexible in what investors want to look at and participate in.”

Stenner Wealth Partners+ at CG Wealth Management is an ultra-selective boutique. Each year, Stenner and his team vet more than 100 prospective clients and onboard only eight large clients.

They are able to rely on:

16 highly trained experts servicing 48 clients in Canada and the US

3:1 client-to-advisor ratio

“We focus exclusively on ultra-high-net-worth families, family offices, and entrepreneurs,” says Stenner. “Ten million is our minimum investment household size, and typically it’s $25 million or more of net worth. Two and a half billion is our wealthiest client.”

Stenner Wealth Partners+’ achievements include:

maintaining an average household investment account of almost $28 million

having a 43 percent defensive cash position as a hedge against economic downturns or recessions

driving a 184 percent increase in client assets under management (AUM) in one year

facilitating 300+ charitable donations worth $100+ million over the past two years for donors across Canada

The nature of Stenner’s clientele means he has to tailor his advising style to suit their requirements.

“When your investors or clients have that type of net worth, you have to build trust with them, whether it’s a family office or their advisors around them,” he says. “Point of trust is paramount.”

Alongside that, the higher-worth clients are accustomed to being given detailed breakdowns.

“They expect you to have not just good product knowledge but expert product knowledge, especially in the higher wealth brackets,” Stenner says. “At the end of the day, we’re in the business of serving our clients first and foremost exceptionally well.”

Wenbo (Davis) Zhang is another 5-Star Advisor who leads Exempt Market at Pinnacle Wealth Brokers. To stand out from the competition, the firm offers:

in-house portfolio managers who deliver personalized service based on clients’ risk tolerance and preference for portfolio diversification

internal compliance officers, a chartered financial analyst, and a chartered accountant

a suite of technological solutions that bolster the firm’s customer service capabilities

Zhang has 16 years of experience in the private market and is known for offering free seminars to inform people about financial matters.

“We regularly provide financial literacy education to investors. Financial literacy is the key for clients to manage their own portfolios and manage their own families well,” he says.

Chris Anderson of Riverrock Private Wealth Partners at Harbourfront Wealth Management is an advocate of the firm’s EASY process:

E – ELIMINATE anxiety

A – ARCHITECT the solution

S – SIMPLIFY

Y – YOU as the client

“That’s the overarching process we use with clients,” says Anderson. “We really drill down and simplify the communication and put things in terms they’ll understand.”

And he adds, “I joke with my clients all the time and say if I can’t explain it to you on the back of a napkin, then I’m not doing my job and I don’t know what I’m talking about. Because there’s nothing that we shouldn’t be able to break down into simple layman’s terms.”

What’s more, the firm leverages its partnership with Harbourfront to deliver exclusive products, such as private equity, private credit, and private real estate at the retail level.

“Harbourfront recently commissioned an Ipsos survey that found one in four Canadians surveyed feel they are missing out on investment products they want, and nearly half of Canadians are open to switching financial institutions or advisors to gain better access to investments,” says Anderson.

“But we’re making that available to accredited investors with accessible multi-manager private securities called AMMPS, and that’s exclusive at Harbourfront. And to the best of our knowledge, there’s nobody else there who’s doing this at the retail level, and we are definitely the first offering retail-friendly AMMPS.”

Anderson also underscores the need to be mindful of not overpromising.

“You need to home in on products that you’re comfortable with and build a repertoire and knowledge of those products,” he says. “And, again, you need to be able to communicate that to your clients, so they understand what they’re actually buying. It’s like waves in the ocean. As soon as you go over one, there’s another one coming.”

In addition, Anderson uses his financial skills to benefit his community by:

leading philanthropic efforts with Uncles and Aunts at Large in the Edmonton area

initiating family food drives

supporting various children’s charities

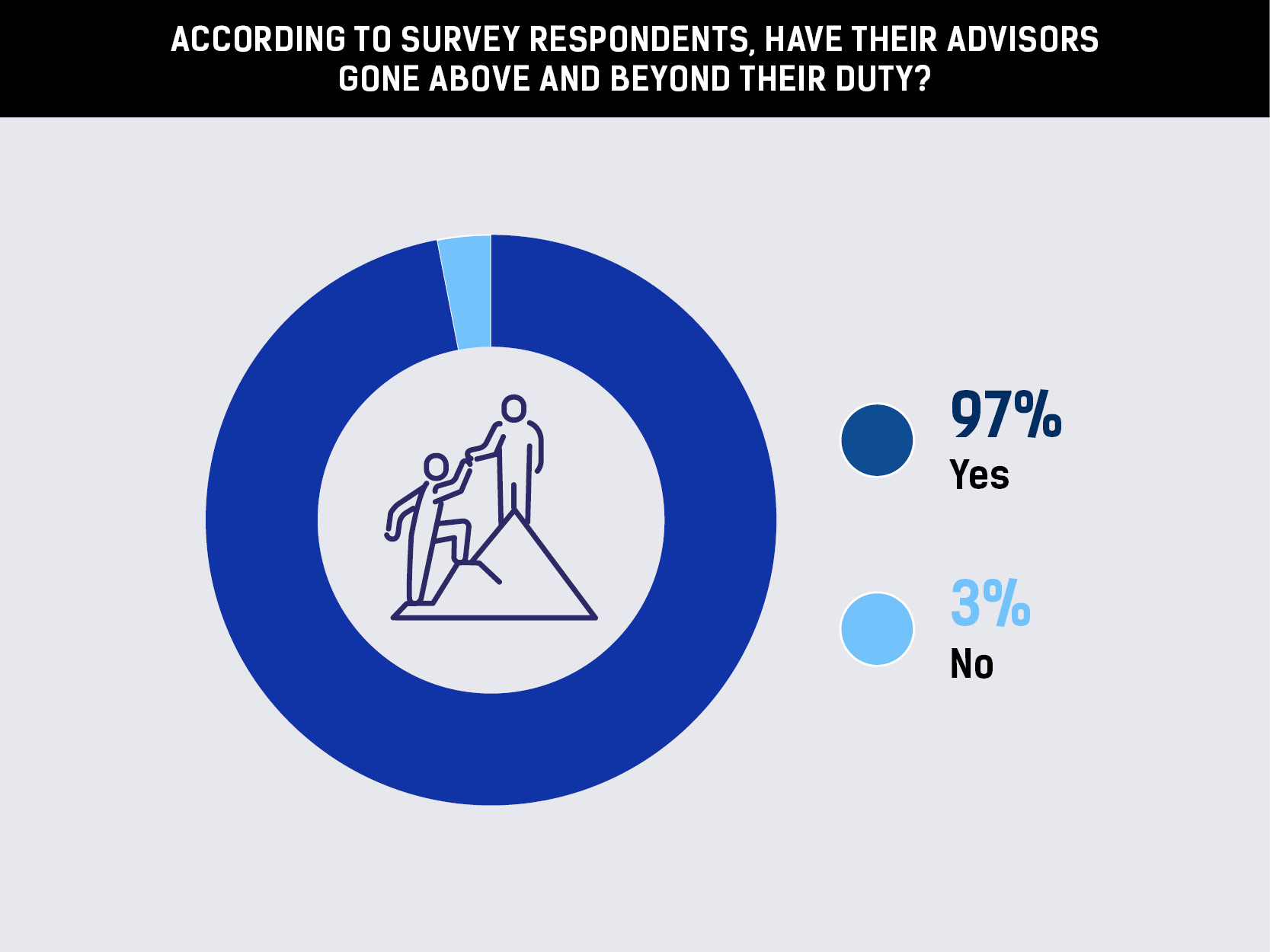

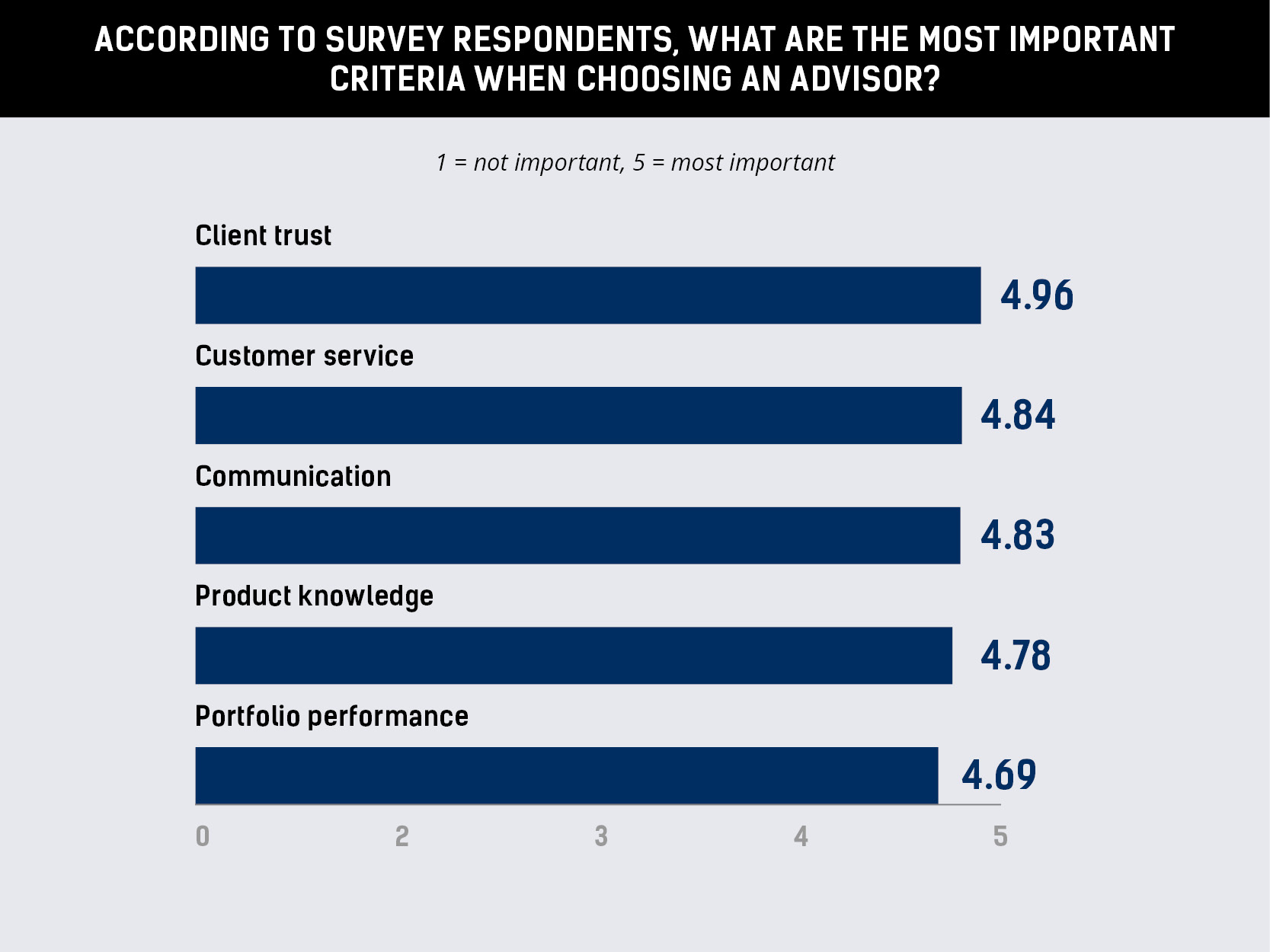

For the 5-Star Advisors – Western Canada 2023 awards, WP surveyed investors in the region to find out how they would rate their advisors.

According to the respondents, the following criteria are the most important.

Investors also offered insight into how their advisors go above and beyond.

Thane Stenner

“Understands my needs outside of investment management.”

“First is responsibility to clients, but also to the community we live in.”

Chris Anderson

“Looks at both big picture and immediate needs.”

“Keeps in contact with us, ensuring that we are still comfortable with our current risk assessments.”

Wenbo (Davis) Zhang

“Communication is first-class. Davis has demonstrated for a number of years that he cares about his investors and continues to look for the best opportunities to grow and protect their capital.”

“His consistency in focusing on alternative investments gives real value to investors. Besides the investments, I appreciate his ability to research and source information.”

“The knowledge he shared with me has really changed my concept of diversification of portfolios.”

Based in Vancouver, Stenner and his colleagues help manage $1.75 billion. One-third of his clients are based in Western Canada.

“I would characterize the current climate in Western Canada as dispersed,” he says. “Alberta went down earlier in their economic cycle, and they seem to have stabilized and are doing better than some other parts of Canada right now.

“The oil and gas industry, which was struggling eight or nine years ago, has stabilized, and we’re probably going to have a good run here over the next couple of years.”

Vancouver-based Zhang specializes in real estate and has been riding the population boom in British Columbia.

“In the past five years, seven cities in British Columbia experienced up to 14 percent growth,” says Zhang. “This resulted in growing demand for the housing market, especially since March of last year when the interest rates started going up.”

Meanwhile, Anderson sees a few other trends at work.

“We’re going to continue to see advisors move from large institutions, primarily big banks, to more independent dealers,” he says. “The reason is they’re able to give more customized solutions, which their clients are demanding.

“Sixty percent of Canadians are not familiar with private investments, but there’s a huge demand for pension-style asset management. We’re able to bring that down to the retail level and make it accessible.

“Another trend is intergenerational wealth transfer – something thriving not only in Western Canada but also in the rest of North America.”

Wealth Professional conducted its second annual search for 5‑Star Advisors in Canada. Our goal was to answer one question: who are the best advisors in Western Canada when it comes to acting in their clients’ interests? From a diverse cross-section of financial professionals, we got the opportunity to spotlight remarkable examples of passion, dedication, and commitment.

From April 17 to May 12, the WP team undertook a rigorous marketing and survey process, leveraging its connections to thousands of advisors across the country. Investors were asked to nominate their advisors and rate them on five key criteria: communication, portfolio performance, product knowledge, client trust, and customer service.

The most voted-for advisors that received an average score of 4 or higher were named 5-Star Advisors who were recognized based not on AUM but rather the service provided to their clients.

The 5-Star Advisors – Western Canada 2023 report is proudly supported by the Canadian Association of Alternative Strategies & Assets (CAASA).

CAASA is Canada’s largest association representing the alternative investment industry with more than 370 members nationwide — including alternative investment managers, pension plans, foundations, endowments, family offices, and service providers. Its membership and activities span all alternatives from hedge funds and venture capital to real estate and cryptocurrencies.

Founded in 2018, CAASA’s mission is to bring Canada to the world and the world to Canada by promoting information sharing, networking, and collaborative initiatives between its members and the industry at large.