Fraser Institute says that a two-rate system would fuel economic growth

Canada’s tax system should be reformed with three middle income rates scrapped and the top marginal rate reduced.

The radical plan has been tabled by the Fraser Institute in a report titled ‘Enhancing Economic Growth Through Federal Personal Income Tax Reform.’ As the title suggests, the non-partisan think tank believes that making some changes to the tax system would be beneficial to Canada’s economic growth.

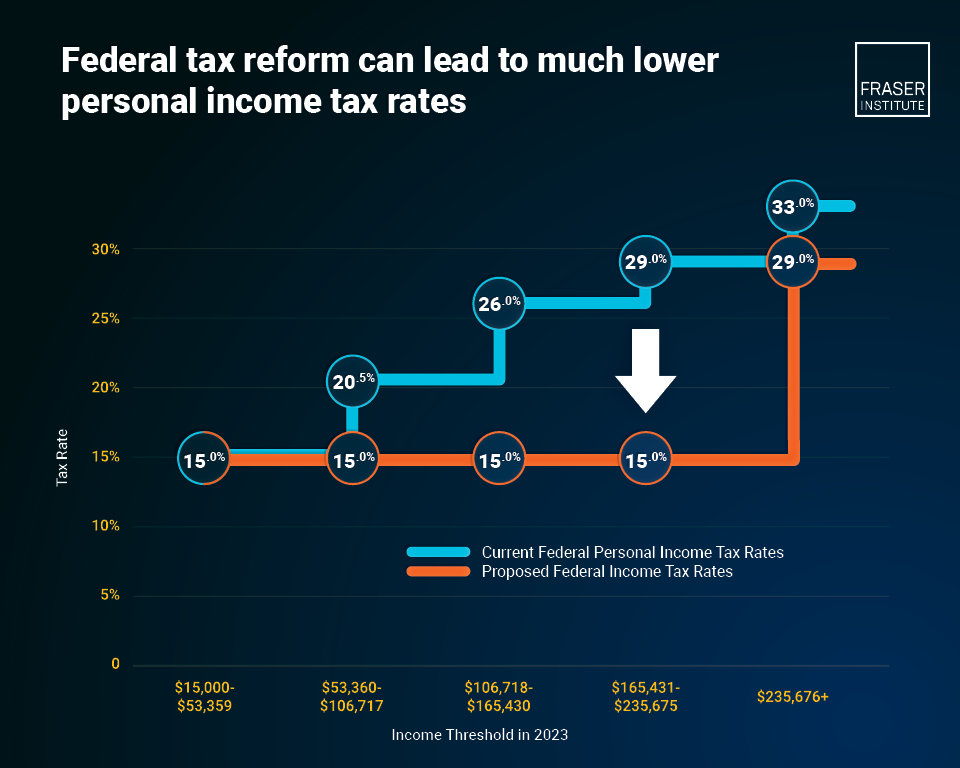

Key to the plan is cutting the top marginal rate to the 29% rate it was at before the government increased it. In 2024, those with taxable incomes above $246,752 ($235,676+ in 2023) pay 33%, with this percentage introduced in 2016, having been 29% since 1988.

When provincial tax rates are factored in, the report finds that only Alberta, Ontario, and BC rank favourably with U.S. states such as Hawaii, California, and Montana, however the combined rates are still at the higher end of the tax scale (near 30%) compared to states including Florida, New Hampshire, and Texas at 22%.

The report says that the three federal middle income tax rates – 20.5%, 26%, and 29% - could be eliminated altogether.

By simplifying rates and other parts of the tax code, including the wide range of credits, deductions, and other special preferences that remain even after the government axed 146 tax credits in 2016, would be positive for the economy and help boost competitiveness with the United States.

“Many of these tax expenditures do little to improve economic incentives and spur growth. The layering of tax expenditures for certain population groups or activities distorts the tax system and creates biases against individuals who are not eligible for these preferences,” the report states.

The research identifies 49 of tax expenditures that could be scrapped to allow the general rates of taxation to be reduced. However, the federal government would also need to reduce spending by $5.6 billion to cover the costs of the proposed tax reforms.

Pro-growth environment

“With this plan for tax reform, the federal government could create a more pro-growth environment than Canadians are presently living in,” said Jake Fuss, director of fiscal policy at the Fraser Institute and study co-author.

The report calculates that most Canadians would face a marginal tax rate of 15% if these reforms were adopted, with top earners paying 29%.