Global survey finds North American investors most likely to allocate more to fixed income factor investing

Increasing interest in fixed income factor investing is being driven by investors in North America according to a new survey.

Invesco’s global poll has discovered a growing thirst for allocations to factor investing with 45% planning to increase factor allocations. This share rises to 65% though among North American respondents.

"The Invesco Global Factor Study demonstrates that there is wider, more dynamic adoption of factor investing, suggesting growing maturity and sophistication in the factor market," said Mo Haghbin, COO, Invesco Investment Solutions. "Factor investing has shifted from academic theory to an actionable strategy for global investors and the study allows us to understand what issues are key to their investment decisions."

The rise in sentiment is backed up by the results with 66% of respondents globally reporting that their factor investments met or exceeded expectations in 2019 compared to the performance of their traditional active or market-weighted allocations.

Factors are mainstream

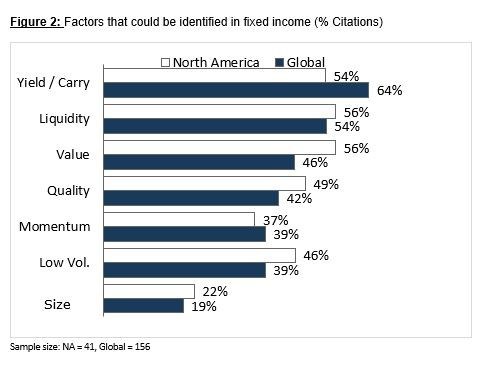

The survey revealed that 61% of institutional investors and 76% of wealth managers now believe factor investing can be extended to fixed income, with recognition that the returns of all fixed-income portfolios, whether they are built utilizing a factor-based approach or not, will be implicitly driven by exposure to factors.

"With interest rates now at record lows and around a quarter of bonds globally trading with negative yields, attention has turned to alternative ways of accessing the asset class," continued Haghbin. "Respondents see factor investing as a solution that could target sources of returns transparently and cost effectively, even in a challenging yield environment."

Active is preferred

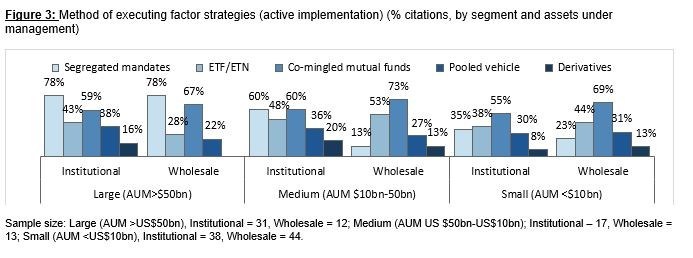

Most factor investors now choose an active implementation as opposed to a passive approach – with active strategies executed through segregated mandates, co-mingled mutual funds, customized investment solutions and exchange traded funds (ETFs).

"The increase in dynamic factor investing is a key sign of how comfortable investors are becoming in implementing factor strategies," continued Haghbin. "We continue to rely on the insight provided by the Global Factor Study to enhance our products and services in order to provide investors with the factor solutions that best fit their needs."

The study also found a shift towards defensive factors although value remains the most widely allocated factor.

"A concurrent increase in the use of other factors, particularly low volatility, momentum, and quality, has resulted in a 'flattening out' of factors in use, and a narrowing in the gap between the most used and least used factors," offers Vincent de Martel, Senior Invesco Investment Solutions Strategist. "Our study found that most investors, seek to capture a dynamic, long-term approach to factor implementation that includes periods of underperformance and outperformance across all factors."